CloudHealth Is A Prospect For Acquisition

Jul 10, 2017

Jeremy Parkinson

Finance

According to Gartner, more than $1 trillion in IT spending will be directly or indirectly affected by the shift to cloud by 2020, making cloud computing one of the most disruptive forces of IT spending since the early days of the digital age. CloudHealth’s cloud management platform is riding this wave of corporate cloud adoption. […]

Confident Americans Set To Spend Record Amount On Summer Vacation

Jul 10, 2017

Jeremy Parkinson

Finance

For the next couple of months, your Facebook and Instagram feeds will likely be dominated by beach holiday photos, beers in the sand and people’s legs at the pool. School is out for summer and people are ready to vacation! American consumers are as confident as ever and this should translate to a great summer […]

Intel Downgraded To Underperform From Hold At Jefferies

Jul 10, 2017

Jeremy Parkinson

Finance

Jefferies analyst Mark Lipacis downgraded Intel (INTC) to Underperform, his firm’s equivalent of a sell rating, and cut his price target on the shares to $29 from $38. Intel closed Friday up 25c to $33.88. The chipmaker’s Xeon/Xeon PHI platform is disadvantaged versus Nvidia (NVDA) in emerging parallel workloads like deep neural networking, Lipacis tells […]

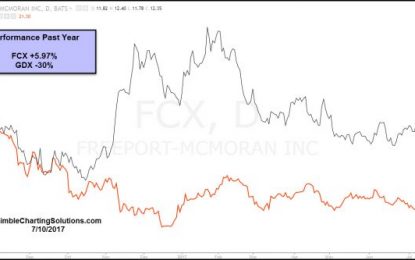

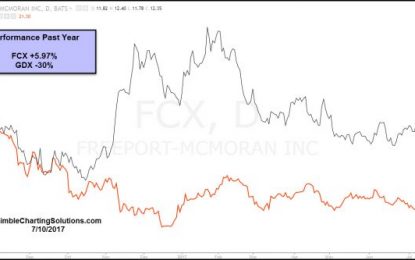

This Mining Stock Much Stronger Than GDX

Jul 10, 2017

Jeremy Parkinson

Finance

The past year has been rough for Gold Mining stocks, as Gold Miner ETF (GDX) has declined over 30%, in the chart below. Below compared GDX to Freeport Mcmoran (FCX) over the past year, reflecting a large difference in performance. Over the past year, GDX has been a good asset to avoid from a buy and hold basis and […]

Recent Flow Reports

Jul 10, 2017

Jeremy Parkinson

Finance

According to EPFR, investors were net sellers of European equity funds in the week ending July 5 for the first time since March. This appears to have ended the longest buying streak in a couple of years. Rising yields and valuations were thought to have injected a note of caution as well as some re-weighting at […]

Chris Powell: Futures Markets Give High-Volume Trading Discounts To Governments

Jul 10, 2017

Jeremy Parkinson

Finance

Listen to the Podcast Audio: Click Here Mike Gleason (Money Metals Exchange): It is my privilege now to welcome in Chris Powell, Secretary-Treasurer at the Gold Antitrust Action Committee, also known as GATA. Chris is a long-time journalist and hard money advocate, and through his tireless efforts at GATA, he is working to expose the […]

Key Events In The Coming Week: All Eyes On Yellen, CPI And Retail Sales

Jul 10, 2017

Jeremy Parkinson

Finance

In the usual post-payrolls economic data lull, the focus this week will be on North America, with Chair Yellen’s semi-annual testimony on Wednesday alongside the the BoC, as well as a Friday data deluge in the US including CPI & retail sales. A 25bp hike this week from the Bank of Canada is expected, although […]

Sell-Off Negated For Now

Jul 10, 2017

Jeremy Parkinson

Finance

I would have loved to of seen a greater pullback in the market. And maybe we still get it right here, but Friday’s bounce was highly problematic for the bears. Simply put, they had the market, as they have had time and time again, on the ropes, with a breakdown in key support. All that had to […]

The Great Rotation Continues

Jul 10, 2017

Jeremy Parkinson

Finance

If you own Apple (AAPL) you’re in big trouble. Well, maybe. The Great Rotation continues. The leading technology companies are still trading poorly. They may have another 5% to the downside. But it’s too late to sell them short. It all sets up the sideways “time” correction that I have been predicting for the summer. And what […]

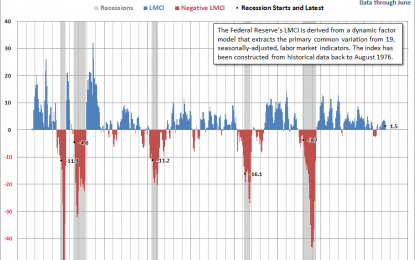

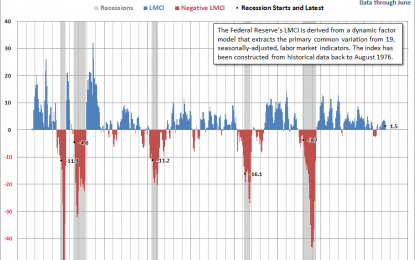

The Labor Market Conditions Index Down In June

Jul 10, 2017

Jeremy Parkinson

Finance

The latest update of the Labor Market Conditions Index for June is at 1.5, down from May’s revised 3.3. The LMCI is a relatively recent indicator developed by Federal Reserve economists to assess changes in the labor market conditions. The cumulative index (discussed below) is currently at its post-recession peak. The indicator, designed to illustrate […]