Oil Prices Bounce Back, GBP Up As EU Approves Brexit Deal – US Market Open

Nov 26, 2018

Jeremy Parkinson

Finance, No picture

MARKET DEVELOPMENT – EUR FIRMS AS ITALY MULLS COMPROMISE, OIL BOUNCES EUR: The Euro is notably firmer with Italian bond yields dipping after reports that the Italian government are discussing reducing the 2019 deficit target to 2-2.1% from the current 2.4% target. This was also followed by comments from Salvini who added that Brussels provided a positive feedback over potentially lowering its […]

A Golden Renaissance

Nov 26, 2018

Jeremy Parkinson

Finance, No picture

A major theme of Keith’s work—and raison d’etre of Monetary Metals—is fighting to prevent collapse. Civilization is under assault on all fronts. The Battles for Civilization There is the freedom of speech battle, with the forces of darkness advancing all over. For example, in Pakistan, there are killings of journalists. Saudi Arabia apparently had journalist […]

3 MFS Mutual Funds For Spectacular Returns

Nov 26, 2018

Jeremy Parkinson

Finance, No picture

Renowned global asset manager MFS aims to provide an array of financial products and services to fulfill the needs of investors as well as 10,000 investment professionals. Based on assets raised in the country or region, the company manages worth over $454.1 billion (as of Oct 31, 2018). The company has 1,700 employees dedicated to […]

Black And Blue Friday

Nov 26, 2018

Jeremy Parkinson

Finance, No picture

Oil price got into the price slashing mode in one of the biggest black Friday collapses since OPEC declared a production war on U.S. producers Thanksgiving 2014. The market went into free fall mode as it was unclear that OPEC, or mainly Saudi Arabia, has the gumption to stand up to President Donald Trump and […]

The Worst Place To Be For Bond Investors

Nov 26, 2018

Jeremy Parkinson

Finance, No picture

Last week, Jeffrey Gundlach of DoubleLine Funds did a webcast where he noted, among other things, that investment grade corporate bonds are terrible. There is no way to win with them, he said. As much as half the investment grade universe could be downgraded to junk, and that will take buyers out of the market […]

Morning Call For Monday, Nov. 26

Nov 26, 2018

Jeremy Parkinson

Finance, No picture

Overnight Markets And News Dec E-mini S&Ps (ESZ18 +1.14%) this morning are up +1.13% and European stocks are up +1.15% as political risks in Italy subsided. The yield on Italy’s 10-year government bond tumbled to a 1-3/4 month low of 3.162% after Italy’s populist government said it is studying scenarios for a lower 2019 budget deficit […]

EUR/USD Rises With Italian Hopes, But Has It Gone Too Far?

Nov 26, 2018

Jeremy Parkinson

Finance, No picture

EUR/USD is recovering in range on some willingness to compromise from Italy. There are quite a few other concerns. The technical picture remains mostly bearish. EUR/USD is trading above 1.1350, recovering from the lows in the wake of the last week of November. The central driver is Italy’s willingness to compromise on the budget deficit. Deputy […]

USD/CAD Daily Analysis – Monday, Nov. 26

Nov 26, 2018

Jeremy Parkinson

Finance, No picture

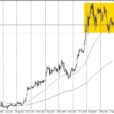

USD/CAD failed to break below the bottom support trend line of the price channel on the 4-hour chart, suggesting that the pair remains in the uptrend from 1.2782. Another rise could be expected in the coming days and next target would be at 1.3400 area. Only a breakdown below the channel support could signal completion […]

AUD/USD Weekly Analysis – Monday, Nov. 26

Nov 26, 2018

Jeremy Parkinson

Finance, No picture

AUD/USD moved sideways in a trading range between 0.7201 and 0.7277. As long as 0.7277 resistance holds, the sideways movement could be treated as consolidation for the downtrend from 0.7337 and a breakdown below 0.7201 support could trigger further downside movement towards 0.7100. On the upside, a break of 0.7277 resistance would indicate that the […]

XOI.X Cycle Model Chart – Monday, Nov. 26

Nov 26, 2018

Jeremy Parkinson

Finance, No picture

2018.11.25 XOI.X Cycle Model Chart The model continues to converge, but there is a continuing right phase shift and a wide discrepancy between actual and predicted suggesting lower prices are much less probable. Note also the change in the right axis descriptors, as the maximum has decreased from 2800 to just under 2200. A previous […]