Forex Weekly Outlook – Sep. 11-15

Sep 10, 2017Jeremy Parkinson0

The US dollar had a bad week, losing ground across the board with no exception. US inflation and consumer figures stand out in the week before the all-important Fed meeting. Here are the highlights for the upcoming week. The euro was not convinced by Draghi’s concern about the exchange rate and advanced. The pound got a boost from […]

The “Squeeze” In The Gold Miners ETF

Sep 10, 2017Jeremy Parkinson0

Price on the following GDX Monthly chart is currently being squeezed in between major resistance of a 23.6% Fib retracement level and a recent breakout above a long-term downtrend line. We’ll see if it continues to rally — maybe to 30.00 or even 33.00 — but there is a lot of overhead price supply, so that could be quite a long […]

Buy These 3 Dividend Stocks To Hedge Your Bets

Sep 10, 2017Jeremy Parkinson0

The S&P 500 is trading close to its 52-week highs meaning that average shares in the index are trading at lofty valuations. They may have good reason to do so: the jobs data is encouraging, wages are trending higher, consumer confidence is rising and consumer spending appears stable (according to schwab.com). Additionally, oil prices are […]

Dollar Drop Crosses 12%: Can Inflation Turn The Tide Ahead Of The Fed?

Sep 10, 2017Jeremy Parkinson0

Fundamental Forecast for USD: Neutral The U.S. Dollar extended its bearish run this week, as ‘DXY’ moved-down every day, Monday thru Friday. This now accounts for a drop of -12.34% from the DXY high on the second trading day of the year down to this morning’s low. After a doji had shown up on Wednesday […]

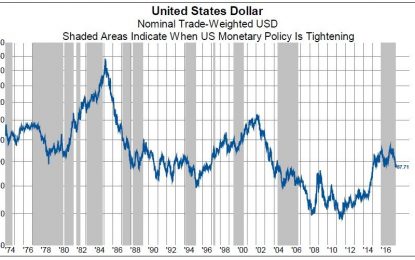

Back To The Future: A US Dollar Bear Market?

Sep 10, 2017Jeremy Parkinson0

By Knowledge Leaders Capital This slide package is our Knowledge Leaders Strategy mid-quarter update and can be downloaded at the link below. The discussion is broken into three sections: SECTION 1: History does not support the view that the USD is propped up by a monetary tightening cycle. The US Dollar’s moves are more fundamentally based on […]

The Question Every Goldman Client Is Asking – ‘Is An Equity Correction Imminent?’

Sep 10, 2017Jeremy Parkinson0

You’re a Goldman client. Ok, no you’re not. But let’s pretend. What is it you’re thinking about these days? Well as it turns out, you’re thinking the same thing everyone else is thinking (with the possible exception of Target managers-turned hedge fund titans buying XIV on dips with other people’s money). Namely, you’re thinking this: […]

Bulls Get Benefit Of Doubt, But…

Sep 10, 2017Jeremy Parkinson0

It’s a new week, so let’s start things off right with an objective review of my key market models/indicators and see where things stand. To review, the primary goal of this exercise is to try and remove any subjective notions about what “should” be happening in the market in order to stay in line […]

USD/CAD Forecast Sep. 11-15

Sep 10, 2017Jeremy Parkinson0

Dollar/CAD had a dramatic week, crashing on another hawkish hike from the BOC. Can it break under 1.20? Manufacturing sales stand out this week. Here are the highlights and an updated technical analysis for USD/CAD. The BOC did it again. The Bank of Canada raised interest rates, and that was not fully priced in. They also […]

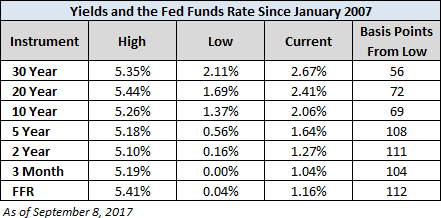

Treasury Snapshot: 10-Year Yield At 2.06%, Lowest Levels Since November

Sep 10, 2017Jeremy Parkinson0

Note: We’ve updated this commentary with data through Friday’s market close. Let’s take a closer look at recent activity in US Treasuries. On Friday, the yield on the 10-year note ended the day at 2.06% and the 30-year bond closed at 2.67%, some of the lowest levels since November of 2016. Here is a table […]

Weekly Economic & Political Timeline – Sunday, Sept. 10

Sep 10, 2017Jeremy Parkinson0

This week will have a relatively full news agenda, including some items of key U.S. data. The agenda will be dominated by monthly policy commentaries and bid rates from the Bank of England and the Swiss National Bank. Therefore, volatility this week should be at a similar level to last week, helped by the fact […]