EC The Bear’s Lair: Cryptos Are Sounder Than Today’s Currencies

Sep 11, 2017Jeremy Parkinson0

Crypto-currencies are an entirely imaginary form of money, dreamed up by pimply nerds in basements. Or so it seemed. Yet examine the algorithms behind some of the better crypto-currencies, and look in contrast at the monetary policies that have devastated the last decade. You will recognize two things. First, fiat money is fiat money, whether […]

US Dollar Downtrend Persisting For One Major Reason

Sep 11, 2017Jeremy Parkinson0

Video length: 00:08:10 Having been out of the office for the past week on annual leave, it always piques my interest to return to markets after an extended period away. Unfortunately for the US Dollar, nothing significant has changed over the past 10 days: the can was kicked down the road on the US debt limit; […]

Strong Start To The Week; Capital Goods & Power Stocks Rally

Sep 11, 2017Jeremy Parkinson0

Indian share markets continued to trade strong in the afternoon session amid strong global markets. At the closing bell, the BSE Sensex closed higher by 195 points and the NSE Nifty finished up 71 points. The S&P BSE Mid Cap finished up by 0.7% while & S&P BSE Small Cap too finished up by 0.8%. Gains were largely seen in capital goods stocks, power stocks and bank stocks. […]

Positive Expectations As Investors’ Sentiment Improves

Sep 11, 2017Jeremy Parkinson0

Briefly: Intraday trade: Our Friday’s neutral intraday outlook has proved accurate. The S&P 500 index continued to fluctuate within its week-long trading range. The broad stock market is likely to open much higher today following futures contract rally after an overnight gap-up opening. We can see some short-term technical overbought conditions. Therefore, intraday short position […]

How To Position For Further CAD Strength Post-BoC – TD

Sep 11, 2017Jeremy Parkinson0

The Bank of Canada’s hawkish hike has sent the loonie skyrocketing. What’s next? Here is the view from TD: Here is their view, courtesy of eFXnews: TD FX Strategy Research notes that the BoC surprised the market consensus at its September meeting hiking the policy rate another 25bp. The Bank has now removed the insurance cuts and […]

Morning Call For Monday, Sept. 11

Sep 11, 2017Jeremy Parkinson0

OVERNIGHT MARKETS AND NEWS Dec E-mini S&Ps (ESZ17 +0.47%) this morning are up +0.55% at a 1-week high and European stocks are up sharply by +1.18% at a 3-week high after the impact of Hurricane Irma is smaller than initially feared and as North Korean tensions eased after it did not conduct a missile test over […]

Status Quo In Flux On Federal Reserve Board

Sep 11, 2017Jeremy Parkinson0

Last week Fed vice-chair Stanley Fischer announced that he will leave the board of governors next month for personal reasons and eight months before his term was to expire. The timing opens up an unprecedented fourth vacancy on the Fed board of governors. In addition, Chair Janet Yellen may not be reappointed when her term […]

FX COT Update: Sterling Selling Pressure Building, BOE In Focus

Sep 11, 2017Jeremy Parkinson0

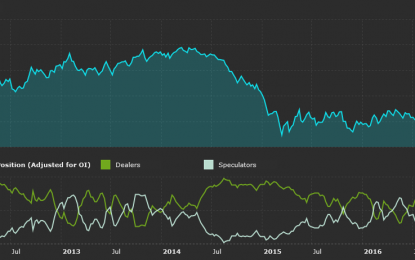

EUR/USD Non-Commercials increased their net long positions in the Euro last week buying a further 9.8k contracts to take the total position to 96k contracts. This latest increase in buying strength came ahead of the ECB’s September meeting which was widely expected to see the bank announcing further QE tapering. Despite the high level of […]

EC Contrasting Opportunities In EM: FX, Equities And Bonds

Sep 11, 2017Jeremy Parkinson0

Year-to-date, over $32 billion has flowed into emerging market (EM) exchange-traded funds (ETFs) in the U.S.1 As a consequence, EM equities, bonds, and foreign exchange (FX) markets are outperforming most developed markets by a sizeable margin. Despite a proliferation of choices over the last several years, WisdomTree continues to advocate a multi-asset approach to EM. Below, we contrast […]

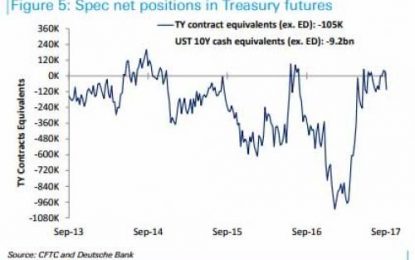

Why One Trader Thinks Calls For A Yield Rebound Are Wrong

Sep 11, 2017Jeremy Parkinson0

With the 10Y nearly touching a 1-handle ahead of this weekend’s battery of potential risk-off events, none of which however materialized in their worst-case outcome, many are once again calling for a bottom on yields, especially as net spec shorts rose over the past week according to the latest CFTC COT data. And yet, not […]