Planes, Trains, And Hurricanes

Sep 10, 2017Jeremy Parkinson0

As if dealing with Harvey wasn’t enough, Hurricane Irma (his not so distant cousin) has already wreaked havoc along its path through the Caribbean. It now looks to do a lot more damage. Hurricane Jose, Irma’s younger brother, is also lurking. In fact, Irma is heading right to Florida, targeting President Trumps federally insured Mar […]

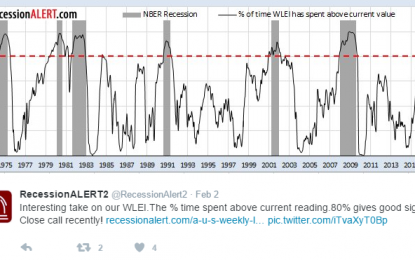

RecessionAlert Weekly Leading Index Update – Sunday, Sept. 10

Sep 10, 2017Jeremy Parkinson0

The latest index reading came in at 17.8, down from 19.2 the previous week. The RecessionAlert Twitter Feed, @RecessionAlert2, had an interesting observation about the indicator levels in February. RecessionAlert has launched an alternative to ECRI’s Weekly Leading Index Growth indicator (WLIg). The Weekly Leading Economic Index (WLEI) uses fifty different time series from these categories: Corporate Bond Composite, […]

Forex Forecast: Pairs In Focus This Week – Sunday, Sept. 10

Sep 10, 2017Jeremy Parkinson0

The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to […]

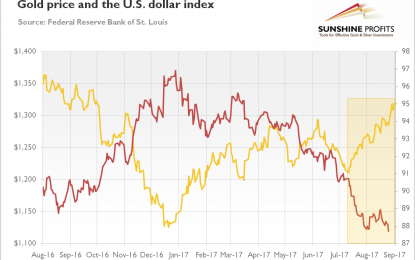

Will Gold Break Out Of Sideway Trading?

Sep 10, 2017Jeremy Parkinson0

Since July 11, gold has been in a short-term upward trend. The yellow metal has gained more than 8 percent since then until the end of August, mainly thanks to the depreciation of the U.S. dollar, as one can see in the chart below. Chart 1: Gold prices (yellow line, left axis, London P.M. fix) […]

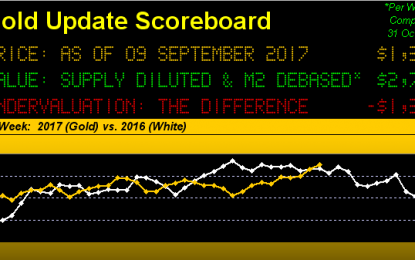

Gold Rolls Higher On Casters Midst Natural Disasters

Sep 10, 2017Jeremy Parkinson0

Given a world rife these days with natural disasters, from hurricanes Harvey and Irma, to Mexico’s monstrous quake and the madman of the NorK, Gold continues to roll higher, now having recorded “higher highs” in seven of the past eight weeks. High times indeed, for as in the above panel we see that Gold is […]

GDPNow Vs. Nowcast: When Will Hurricane Adjustments Take Place?

Sep 10, 2017Jeremy Parkinson0

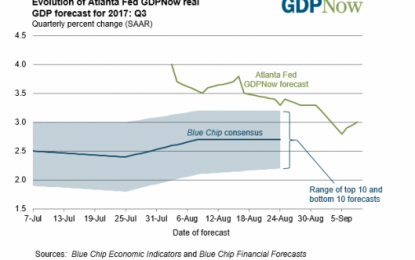

On Friday, GDPNow and the FRBNY Nowcast both posted third-quarter GDP estimates. GDPNow stands at 3.0%. The Nowcast is at 2.1%. Inquiring minds may be wondering what Hurricanes Harvey and Irma will do to their models. First, let’s review the latest forecasts. GDPNow Forecast: 3.0 Percent — September 8, 2017 The GDPNow model forecast for real GDP growth (seasonally […]

GBP/USD Forecast Sep. 11-15

Sep 10, 2017Jeremy Parkinson0

GBP/USD had a tense week amid tense Brexit negotiations but came out on top. The upcoming week features top-tier inflation and jobs indicators, as well as the BOE decision. Here are the key events and an updated technical analysis for GBP/USD. The pound enjoyed the talk about a soft Brexit, but perhaps more importantly, a weak US […]

History Shows, Buy QQQ And Sell KRE On Monday

Sep 10, 2017Jeremy Parkinson0

For the Modern Family, Friday was not much more than a continuation of the consolidation that had been going on since Tuesday. There were some notable exceptions like IYT which had a strong day on Friday, closed of the day and the high of the week and over its 50-DMA. Acually, a strong Friday is […]

ECRI Weekly Leading Index: WLI Down

Sep 10, 2017Jeremy Parkinson0

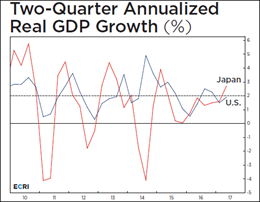

The latest release of the publicly available data from ECRI puts its Weekly Leading Index (WLI) at 141.8, down from the previous week. Year-over-year the four-week moving average of the indicator is now at 3.69%, down from 4.36% last week. The WLI Growth indicator is now at 0.9, also down from the previous week. “Finding […]

Weighing The Week Ahead: Have The Odds Improved For A Market-Friendly Policy Agenda?

Sep 10, 2017Jeremy Parkinson0

We have a normal data calendar. Central to stock market prospects is the resolution of several key policy issues. The possible outcomes have a wide range of market impacts, from fear to a major boost in corporate earnings. The debt limit/Harvey aid deal between President Trump and Democrats was a surprise to most. Still digesting […]