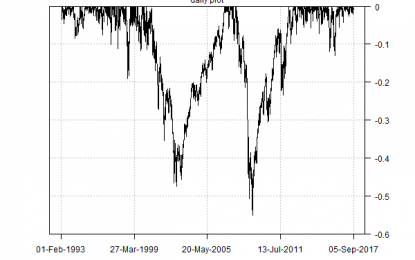

Modeling Expected Drawdown Risk

Sep 06, 2017Jeremy Parkinson0

There are no silver bullets for profiling risk, but drawdown’s properties arguably give this metric a leg up over most of the competition. The combination of an intuitive framework, simplicity, and sharp focus on how markets actually behave is a tough act to beat. Perhaps the strongest argument in favor of drawdown can be summed up by […]

Nomura Ups Apple Target To $185 Ahead Of Launch Event

Sep 06, 2017Jeremy Parkinson0

Nomura Instinet analyst Jeffrey Kvaal raised his price target for Apple shares to $185 from $175 ahead of the company’s launch event on September 12. The stock closed yesterday down $1.97 to $162.08. Apple is entering the “long awaited iPhone supercycle on its front foot,” Kvaal tells investors in a research note. Operating system base […]

The Great Shift Of Global Economic Power

Sep 06, 2017Jeremy Parkinson0

BRIC economies continue to grow. In the late 2020s, the size of China’s economy will surpass that of the US. By the early 2030s, the BRICs’ combined economic power will surpass that of major advanced nations. The BRICS Summit in Xiamen, Fujian province, signals the rising might of the large emerging economies, such as China, […]

Yields Tumble, Yen Surges As Perfect Storm Hits Global Markets

Sep 06, 2017Jeremy Parkinson0

Oh, and sorry in advance to Michael: Headline writers, if u find yourself typing ‘It’s a Perfect Storm…’ on top of a story about market risks, please hit backspace & try again — Michael P. Regan (@Reganonymous) September 5, 2017 Just in case you didn’t get the memo, Tuesday is shaping up to be quite […]

Fixed Income: “Enhanced” By Performance

Sep 06, 2017Jeremy Parkinson0

The U.S. interest rate backdrop continues to remain challenging for investors looking for income. The rise in U.S. Treasury (UST) yields following last November’s Election Day, and a bit more recently around the Federal Reserve’s (Fed) first rate hike in 2017, allowed investors to possibly believe that rates may finally be making a more permanent move higher. Or, at the very least, that […]

Sensex Ends The Day In The Red; Healthcare Stocks Slump

Sep 06, 2017Jeremy Parkinson0

After opening the day marginally lower, share markets in India continued to witness selling pressure in the afternoon session and ended the day in red. Losses were seen across most sectors with stocks in the pharma sector and stocks in the FMCG sector, leading the losses. While stocks in the witnessed buying interest. At the closing bell, the BSE Sensex stood lower by […]

Bitcoin/Forex Signal – Wednesday, Sept. 6

Sep 06, 2017Jeremy Parkinson0

Yesterday’s signals were not triggered as there was no bearish price action at $4389.93. Today’s BITCOIN/USD Signals Risk 0.75% per trade. Trades must be taken only until 5pm New York time today. Long Trades Long entry after a bullish price action reversal on the H1 time frame following the next touch of $4389.93 or $3974.75. Place […]

What Is Quadruple Witching And Can You Take Advantage Investing During It?

Sep 06, 2017Jeremy Parkinson0

If you’re like me, you’re always looking for the best return on investment. Can trading around quadruple witching help you earn more? What is quadruple witching and can you use the phenomenon to your advantage when trading stocks? Should you even bother? Quadruple witching is the expiration of stock options and stock futures at the […]

Brexit Briefing: GBP Ignores The Noise, Benefits From Weak USD

Sep 06, 2017Jeremy Parkinson0

The UK media have been full of stories this week about the Brexit timetable, UK access to EU research and development, immigration and the free movement of labor, efforts to lure businesses from London to other EU capitals and the divorce bill. Yet the British Pound and London stocks have sailed serenely through the noise, affected more […]

Book Review: Big Money Thinks Small

Sep 06, 2017Jeremy Parkinson0

Joel Tillinghast, one of the best mutual fund managers, runs the money in Fidelity’s Low-Priced Stock Fund. It has one of the best long-term records among stock funds over the 28 years that he has managed it. The author gives you a recipe for how to pick good stocks, but he doesn’t give you a […]