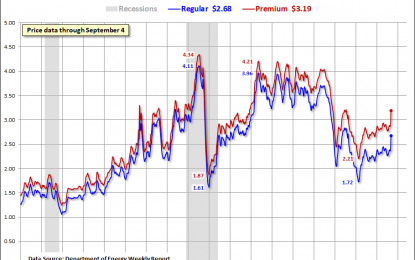

Weekly Gasoline Price Update: Regular And Premium Jump 28 And 29 Cents

Sep 06, 2017Jeremy Parkinson0

It’s time again for our weekly gasoline update based on data from the Energy Information Administration (EIA). The price of Regular and Premium are up twenty-eight and twenty-nine cents each, respectively, from last week. According to GasBuddy.com, California has the highest average price for Regular at $3.13 and San Francisco, CA is the most expensive city, […]

ISM Manufacturing Report Signals 4.9% GDP Growth

Sep 06, 2017Jeremy Parkinson0

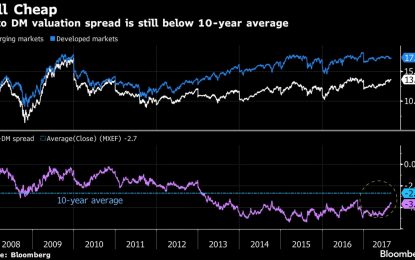

In previous articles, we’ve discussed how emerging markets are outperforming America after several years of underperformance. Emerging markets usually have a lower PE multiple than America and developed markets because their capital markets aren’t as trusted and their political systems are more uncertain. Lately, there has been a silly narrative that because President Trump appears […]

Sensex Opens 180 Points Lower; Realty & Healthcare Stocks Fall

Sep 06, 2017Jeremy Parkinson0

Asian stock indices are lower today as Japanese and Hong Kong shares fall. The Nikkei 225 is off 0.31% while the Hang Seng is down 1.05%. The Shanghai Composite is trading is trading down by 0.4%. US stocks sank yesterday, with the S&P 500 stumbling to its biggest single-day loss in about three weeks, as investors weighed fresh tensions with North Korea. […]

PBoC Strengthens Yuan Fix For Eighth Day – Longest Streak Since 2015

Sep 06, 2017Jeremy Parkinson0

As noted earlier, the offshore yuan snapped a record 14-day winning streak against the dollar on Tuesday after the PBoC strengthened the yuan fix less than expected overnight. Again, it’s all about expectations. That is, the PBoC ostensibly takes the previous day’s action into account when determining the next day’s fix, although during the […]

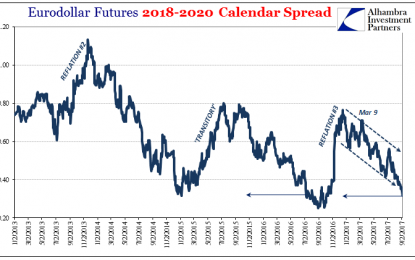

Once Again, Not Korea But March

Sep 05, 2017Jeremy Parkinson0

It’s hard not to put all emphasis on missile tests and other serious forms of sabre rattling. Even doing so, as the bond market may be doing right now, however, misses the underlying. Everything at the moment traces back to mid-March, which in hindsight was a very eventful month in full far away from the […]

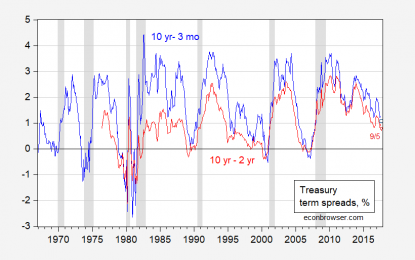

Term Spread – Tuesday, Sept 5

Sep 05, 2017Jeremy Parkinson0

As I was compiling background notes for the new semester, I found the current level and trend in the term spread of interest. Figure 1: Ten year minus three month Treasury spread (blue), and ten year minus two year spread (red), %. Observations for September are 9/5. NBER defined recession dates shaded gray. Source: FRED, Bloomberg, […]

35% Chance Of A Debt Ceiling Crisis

Sep 05, 2017Jeremy Parkinson0

Debt Ceiling Resolved Soon? Goldman Sachs lowered its odds of a government shutdown, caused by the debt ceiling not being raised, from 50% to 35%. These numbers are somewhat arbitrary because there’s no way of knowing the precise odds of a shutdown. This situation is like when analysts come up with price targets which include […]

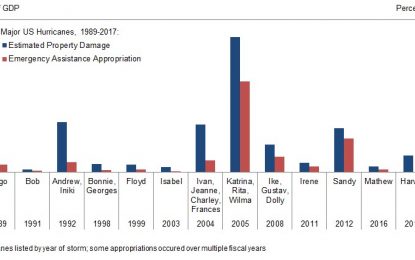

It’s A Stormy Season For Markets Too

Sep 05, 2017Jeremy Parkinson0

The market got a little spooked today. Congress is back in session. Cause and effect? Maybe, because pretty soon hopes of what might be accomplished in by Washington will be met with reality. However, here’s what I’m focussed on. Bonds (TLT) rallied 1.59% which is the biggest 1 day percentage move since June of 2016. […]

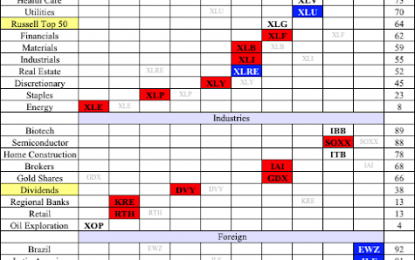

Market Rates – Tuesday, Sept 5

Sep 05, 2017Jeremy Parkinson0

Sector Strength This spreadsheet is telling us to own foreign, large cap and the defensive stocks. The leading sectors are Technology, Health Care, Utilities. These are the sectors that run up when investors are feeling cautious. Some would disagree regarding Technology, but the stellar balance sheets of large cap technology is now considered defensive. Foreign […]

Biopharmaceuticals Portfolio In A Biotech Bull Market

Sep 05, 2017Jeremy Parkinson0

Biotech Bull Market 2017 Performance as of 9/5/17 Rayno Biopharmaceutical Portfolio outperforms the market. XBI was the Best Play up 41.88% YTD. Biotech stocks broke through the July sector highs as tracked by major ETFs. However we are still about 25% off the July 2015 bubble highs but supported by good earnings fundamentals, strong technicals and potentially a seasonal strong Q4. […]