How To Position For Further CAD Strength Post-BoC – TD

Sep 11, 2017Jeremy Parkinson0

The Bank of Canada’s hawkish hike has sent the loonie skyrocketing. What’s next? Here is the view from TD: Here is their view, courtesy of eFXnews: TD FX Strategy Research notes that the BoC surprised the market consensus at its September meeting hiking the policy rate another 25bp. The Bank has now removed the insurance cuts and […]

Morning Call For Monday, Sept. 11

Sep 11, 2017Jeremy Parkinson0

OVERNIGHT MARKETS AND NEWS Dec E-mini S&Ps (ESZ17 +0.47%) this morning are up +0.55% at a 1-week high and European stocks are up sharply by +1.18% at a 3-week high after the impact of Hurricane Irma is smaller than initially feared and as North Korean tensions eased after it did not conduct a missile test over […]

Status Quo In Flux On Federal Reserve Board

Sep 11, 2017Jeremy Parkinson0

Last week Fed vice-chair Stanley Fischer announced that he will leave the board of governors next month for personal reasons and eight months before his term was to expire. The timing opens up an unprecedented fourth vacancy on the Fed board of governors. In addition, Chair Janet Yellen may not be reappointed when her term […]

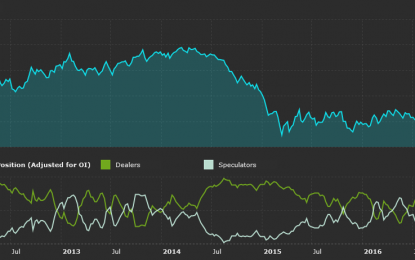

FX COT Update: Sterling Selling Pressure Building, BOE In Focus

Sep 11, 2017Jeremy Parkinson0

EUR/USD Non-Commercials increased their net long positions in the Euro last week buying a further 9.8k contracts to take the total position to 96k contracts. This latest increase in buying strength came ahead of the ECB’s September meeting which was widely expected to see the bank announcing further QE tapering. Despite the high level of […]

EC Contrasting Opportunities In EM: FX, Equities And Bonds

Sep 11, 2017Jeremy Parkinson0

Year-to-date, over $32 billion has flowed into emerging market (EM) exchange-traded funds (ETFs) in the U.S.1 As a consequence, EM equities, bonds, and foreign exchange (FX) markets are outperforming most developed markets by a sizeable margin. Despite a proliferation of choices over the last several years, WisdomTree continues to advocate a multi-asset approach to EM. Below, we contrast […]

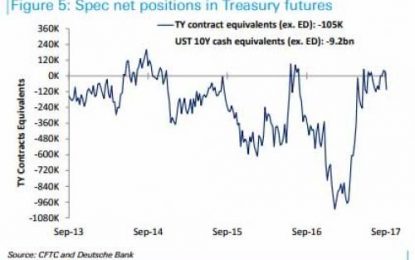

Why One Trader Thinks Calls For A Yield Rebound Are Wrong

Sep 11, 2017Jeremy Parkinson0

With the 10Y nearly touching a 1-handle ahead of this weekend’s battery of potential risk-off events, none of which however materialized in their worst-case outcome, many are once again calling for a bottom on yields, especially as net spec shorts rose over the past week according to the latest CFTC COT data. And yet, not […]

Japanese Shares Surge Amid Asia Rally As Investors Super-Excited World Didn’t End

Sep 11, 2017Jeremy Parkinson0

It’s all green screens out there early on as the relief rally gathered steam in the overnight. Bottom line: Hurricane Irma wasn’t as catastrophic as feared and North Korea decided maybe it wasn’t a fantastic idea to launch another missile ahead of a new sanctions vote in the Security Council where it still enjoys the […]

How To Find The Best Biotech Shares – Every Time

Sep 11, 2017Jeremy Parkinson0

When you’re evaluating most new stocks, it makes good sense to look at technical indicators – such as price-to-earnings ratio (P/E), profit margins, or revenue per share, to name a couple – so you know what you’re buying. But here’s the rub. When you’re scouting a promising biotech stock, the indicators I mentioned just won’t tell you […]

Irma And Harvey Insured Losses Expected To Top $100b, Says Barclays

Sep 11, 2017Jeremy Parkinson0

Barclays analyst Jay Gelb notes initial indications are Hurricane Irma’s impact on Florida could result in insured losses of up to $60B. Irma will likely be the largest storm to ever impact the U.S., although not as bad as if Miami suffered a direct hit, Gelb tells investors in a research note on the insurance […]

Investing Apathy & The Death Of Your Financial Goals

Sep 11, 2017Jeremy Parkinson0

Recently, Ryan Vlastelica penned a column suggesting investors should simply be “apathetic” when it comes to their money. “Apathy doesn’t sound like a sensible investment philosophy, but it may be one of the most successful approaches a person can employ to grow wealth.” Listen. I get it. You can’t beat the market, so just “buy and hold.” Over a long […]