WTI Crude Oil And Natural Gas Forecast – Monday, Sept. 11

Sep 11, 2017Jeremy Parkinson0

WTI Crude Oil The WTI Crude Oil market fell significantly on Friday, breaking down below the bottom of a hammer. That hammer is now a “hanging man”, showing signs of real weakness. Ultimately, there is a lot of concerns when it comes to demand destruction after the hurricanes, and of course refineries being quiet. The […]

The Future Of The Global Economy

Sep 11, 2017Jeremy Parkinson0

If you establish a democracy, you must in due time reap the fruits of a democracy. You will in due season have great impatience of public burdens, combined in due season with great increase of public expenditure. You will in due season have wars entered into from passion and not from reason… – Benjamin Disraeli, […]

Forex Weekly Outlook September 11-15

Sep 11, 2017Jeremy Parkinson0

The US dollar plunged against its counterparts last week following increased Hurricane damage and North Korea missile threat. These uncertainties weighed on economic activities and plunged new job creation. The labor market added fewer jobs, 156,000, in August than expected, below the 180,000 jobs projected by economists and 189,000 recorded in July. Also, while the […]

EUR/USD: Price Sitting On The Balance Line

Sep 11, 2017Jeremy Parkinson0

Previous: On Friday the 8th of September, trading on the euro/dollar pair closed down. After hitting a new high of 1.2092 in Asia, buyers started cashing in on their long positions during the European session. The rate first fell to 1.2036 (-56 pips). During the second wave of euro selling, it fell against the dollar to […]

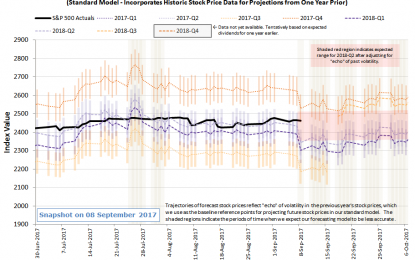

Spaghetti Charts And The S&P 500’s Future In Week 1 Of September 2017

Sep 11, 2017Jeremy Parkinson0

After the last two weeks of seeing so many spaghetti models that forecast the potential trajectory of hurricanes in the news, we can’t help but note that the forecasting charts that we show each week really represent a similar concept being applied to the future path of the S&P 500. Only for us, the difference between the […]

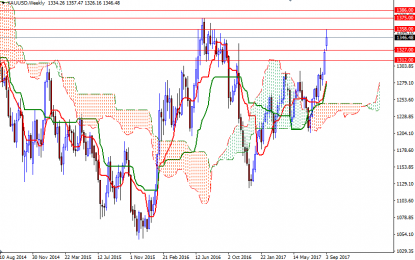

Weekly Gold Forecast – Monday, Sept. 11

Sep 11, 2017Jeremy Parkinson0

Gold prices settled at $1346.48 an ounce on Friday, rising nearly 1% over the course of the week, as safe-haven demand continued to lure investors into the market. The latest data from the Commodity Futures Trading Commission (CFTC) revealed that speculative traders on the Chicago Mercantile Exchange increased their net-long positions in gold to 245298 […]

Macro Mondays: GDP Per Capita

Sep 11, 2017Jeremy Parkinson0

Welcome to another edition of Macro Mondays! Today I want to shift the focus globally and talk about determining how much wealth exists relative to the number of people in individual countries. This is meant to supplement our article a couple weeks ago on which countries possess the strongest economies: today we will talk about part […]

US Equities – Are They Still In A Bull Market?

Sep 11, 2017Jeremy Parkinson0

European investors investing in US equities are not happy. Since March 2017 their holdings are losing value measured in Euro: Source: Stockcharts.com While the S&P 500 (the lower panel of the chart) is still in its strong bull market, its equivalent measured in Euros is in its correction phase (the upper panel of the […]

As A Flurry Of Activity Hits This Week, All Eyes Will Still Be On Apple

Sep 11, 2017Jeremy Parkinson0

After a weekend that was filled with news and analysis surrounding the impact of Hurricane Irma, we’re doing our best to turn our attention to what’s going to be the focus on the trading week ahead. There is something distinctly unnerving seeing equity markets relatively calm when mother nature is tossing a whopping 4 apocalyptic-like […]

Stock Bulls Shake Off Worries About Mounting Global Dangers

Sep 11, 2017Jeremy Parkinson0

As expected, August brought more volatility. Early in the month, the large cap, mid cap, and small cap indices all set new all-time closing highs while the CBOE Volatility Index (VIX) hit an all-time low. But then tough resistance levels failed to yield, the expected late-summer volatility set in, and support levels were tested. Nevertheless, […]