“Shock Event” For 3 Top Insurance ETFs

Sep 10, 2017Jeremy Parkinson0

Price on three top Insurance ETFs has been dropping since mid-August, as shown on the following daily charts of IAK, KBWP and KIE. In the process, they made some extreme lower swing lows on each of their respective three technical indicators, suggesting that further weakness lies ahead. As of Friday’s close, they are trading around their 200-day moving averages, so failure to regain an upward […]

EUR/USD To Stay Bid Ahead Of FOMC As ECB Unveils Post-QE Game Plan

Sep 10, 2017Jeremy Parkinson0

Fundamental Forecast for Euro: Bullish EUR/USD climbs to fresh 2017-highs even as the European Central Bank (ECB) sticks to its current policy, with the pair at risk of extending the advance from earlier this month should key data prints coming out of the U.S. economy continue dampen expectations for three Fed rate-hikes in 2017. The fresh remarks […]

Emerging Markets: What Has Changed- Sunday, Sept. 10

Sep 10, 2017Jeremy Parkinson0

In the EM equity space as measured by MSCI, Brazil (+3.1%), Russia (+1.8%), and Colombia (+1.3%) have outperformed this week, while South Africa (-2.0%), Poland (-2.0%), and Turkey (-1.9%) have underperformed. To put this in better context, MSCI EM rose 0.1% this week while MSCI DM was flat. In the EM local currency bond space, […]

Decision Time For Tech And S&P

Sep 10, 2017Jeremy Parkinson0

The coiling setup from last week unwound itself with a move lower; whether markets have blinked and are ready for further losses or if this is just some ‘bear trap’ remains to be seen. The key test will be whether support from long established rising price channels will hold if such losses continue. The S&P […]

All The Bogeymen Are Here

Sep 10, 2017Jeremy Parkinson0

I am tempted to use one of the most tired clichés to describe the state of play in financial markets. In his famous book with the same title, Malcolm Gladwell describes a tipping point as “the moment of critical mass and threshold” at which point the parameters and rules of the game—in a market or […]

3 Excellent Dividend ETFs For Turbulent Times

Sep 10, 2017Jeremy Parkinson0

U.S. equity markets are going through turbulent times. There is a lot of volatility and uncertainty owing to rising geopolitical risks and political uncertainty. This has increased the appeal for dividend investing. Geopolitical Risks North Korea conducted its sixth nuclear test, that of a hydrogen bomb, which can be mounted on an Inter Continental Ballistic […]

Forex Metrics And Chart Week 37 / 2017

Sep 10, 2017Jeremy Parkinson0

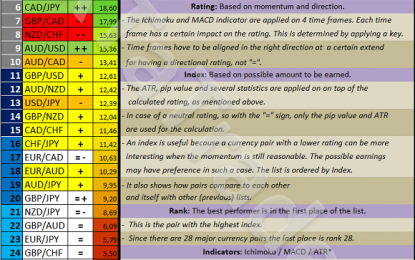

The Top 10 of the Ranking and Rating list for the coming week shows the following stronger currencies being well represented for going long: the CAD(4X) followed by the EUR(2X) with the CHF(2X) and the AUD(2X). The weaker currencies are the USD(4X) followed by the NZD(3X). By diversifying a nice combination can be traded in the coming week […]

Goldman Slashes Q3 GDP By 30% Due To Hurricane Disaster

Sep 10, 2017Jeremy Parkinson0

Yesterday, when commenting on the impact of Hurricanes Harvey and Irma, we noted that even before the two devastating storms were set to punish Texas, Florida and the broader economy, erasing at least 0.4% GDP from Q3 GDP according to BofA and costing hundreds of billions in damages (contrary to the best broken window fallacy, the lost invested […]

Forces Of Movement In FX: The Week Ahead

Sep 10, 2017Jeremy Parkinson0

The US dollar’s selloff accelerated. It has been selling off since the start of the year. The first phase of the decline at the start of the year seemed similar to what happened at the start of 2016. Following the Fed’s first-rate hike at the end of 2015, the dollar weakened in the first several months […]

Markets Hit A Critical Juncture

Sep 10, 2017Jeremy Parkinson0

Stocks end week at a critical juncture. In tonight’s video market update we take a look at all of the critical areas of the market coming at a crossroad. What stocks or sectors are going to hold this market together?