Are Early Elections Really A ’Game-Changer’ For The British Pound?

Apr 22, 2017Jeremy Parkinson0

Fundamental Forecast for GBP: Neutral British Pound Soars As Theresa May Announces Early Elections. GBP/USD Technical Analysis: Breakout or Fake-out?. The big news out of the U.K. this week came on Tuesday morning from Prime Minister Theresa May, in which she surprised the world by announcing that general elections will be held early, on June the […]

Significant Risk Prevalent For The Week Ahead

Apr 22, 2017Jeremy Parkinson0

The major stock indices once again ended a week within the expected move and that is why we have been talking about this in every weekend update for months. Going into next week implied volatility has risen across the board signaling major risk in the market. The expected move in the S&P has not been […]

E Conatus Pharmaceuticals Announces Two Poster Presentations At EASL Conference

Apr 22, 2017Jeremy Parkinson0

On Friday, Conatus Pharmaceuticals (CNAT) presented two posters at the European Association for the Study of the Liver — EASL — conference. This conference took place at Amsterdam, and it is where all biotech companies developing drugs for liver disease go to present. The two posters presented came from a data analysis done by W. […]

Speculators Take Big Positions, Including Shifting To Net Long Mexican Pesos

Apr 22, 2017Jeremy Parkinson0

In the CFTC reporting period ending April 21, speculators added to significant positions in the euro, sterling and the Mexican peso. Bulls and bears took more exposure in the euro and sterling, while in the peso net longs dominated. The gross longs rose 12.2k contracts in the euro to stand at 185.8k contracts.It is the […]

AUD/USD Forecast April 24 – 28

Apr 22, 2017Jeremy Parkinson0

AUD/USD reversed directions last week and posted modest losses. The pair closed the week at 0.7528. This week’s key event is CPI. Here is an outlook on the major market-movers and an updated technical analysis for AUD/USD. In the US, construction figures were mixed and manufacturing and employment numbers missed their estimates. The Aussie softened after the RBA minutes […]

Crude Oil Forecast For May 2017

Apr 22, 2017Jeremy Parkinson0

The price of crude oil was weak last week. Crude oil dropped from $53.20 early this week to $49.62 on Friday. That is a 6.7 percent drop in a week, which is rather significant even for a volatile asset like crude oil. What is InvestingHaven’s crude oil forecast for May 2017? Examining that question is […]

Hedge Fund Performance Is (Still) Improving! Everyone (Still) Doesn’t Care

Apr 22, 2017Jeremy Parkinson0

Earlier this month, we brought you “It’s Probably Too Late: Hedge Fund Performance ‘Improves,’ But Market’s Patience Is Gone.” In it, we highlighted the fact that hedge funds’ risk-adjusted performance is actually improving. But we also noted that at this point, it probably doesn’t matter. The passive/active ship has sailed. That horse has left the […]

Week In Review: Tianjin CanSino Closes $65 Million Round For Vaccine Portfolio

Apr 22, 2017Jeremy Parkinson0

Tianjin CanSino Biologics, a vaccine developer, raised $65 Million in its latest funding round (see story). Currently, CanSino is testing four products in Phase I to III clinical trials, conducted in North America, Africa and China respectively. It also has three IND submissions awaiting CFDA trial approvals. The latest CanSino financing was led by Future Industry […]

Markets Rally As Expected…Now What?

Apr 22, 2017Jeremy Parkinson0

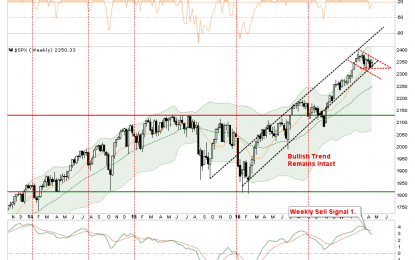

In last weekend’s newsletter, I suggested the markets could rally this week with some very specific caveats. Let’s review where we are. (All charts updated through Friday.) “The market has now tripped the first signal as shown above, and below, sending a warning that further weakness could ensue. With the first signal registered, combined with a break of […]

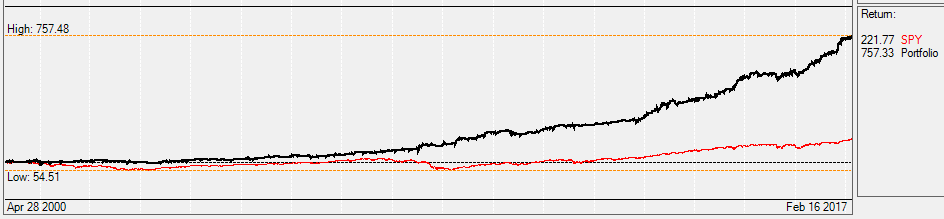

The Long-Short US Sector Rotation Strategy

Apr 22, 2017Jeremy Parkinson0

The following paper will explain how to build a U.S. sector rotation strategy (a US sector rotation meta strategy combining dynamically 5 different sector strategies based on SPDR ETF) which allocates dynamically between 4 different long US sector rotation strategies and one short US sector rotation strategy. This strategy is therefore different from our Global Sector Rotation strategy, as it […]