Economic Data And Forecasts For The Weeks Of April 24 And May 1

Apr 22, 2017Jeremy Parkinson0

Here are my forecasts for upcoming economic data. ` Forecast Prior Observation Consensus Week of April 24 April 24 Chicago Fed National Economy Activity – March 0.4 0.34 0.3 Dallas Fed Manufacturing Survey 18 16.9 15.0 […]

E Bonds And SPX Confirming Sell Signals

Apr 22, 2017Jeremy Parkinson0

VIX appears to have completed the right shoulder of an inverted Head & Shoulders neckline at 16.28. It is on a buy signal above Long-term support at 13.01. A breakout above the neckline suggests that the Ending Diagonal formation may also be at risk of a breach. An actual change in long-term trend may occur […]

Dollar Technicals Trying To Turn

Apr 22, 2017Jeremy Parkinson0

The US dollar turned in a mixed performance last week, as yields stabilized. However, the technical condition still has not turned convincingly in the dollar’s favor against most of the major foreign currencies. On the other hand, our fundamental conviction that the divergence theme remains intact and is the underlying driver continues to inform our constructive outlook. […]

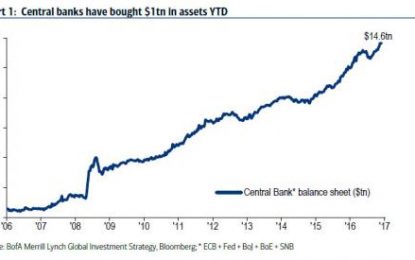

Why “Nothing Matters”: Central Banks Have Bought A Record $1 Trillion In Assets In 2017

Apr 22, 2017Jeremy Parkinson0

A quick, if familiar, observation to start the day courtesy of Bank of America which in the latest overnight note from Michael Hartnett notes that central banks (ECB & BoJ) have bought $1 trillion of financial assets just in the first four months of 2017, which amounts to $3.6 trillion annualized, “the largest CB buying on record.” […]

The Disintegrating Energy Sector Will Make The Entire System Grind To A Halt

Apr 22, 2017Jeremy Parkinson0

Very few Americans realize that the disintegrating energy industry will make the entire economy and market grind to a halt. This won’t happen overnight, but if we look at history over several decades or a century, it will have fallen apart rather quickly. Unfortunately, there is nothing we can do about it because the time to […]

EC Cracks In Ponzi-Finance Land

Apr 22, 2017Jeremy Parkinson0

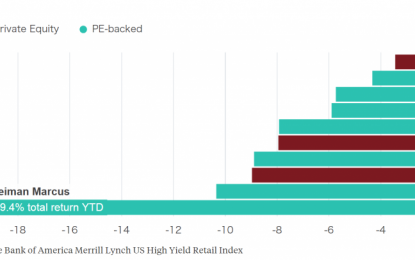

Retail Debt Debacles The retail sector has replaced the oil sector in a sense, and not in a good way. It is the sector that is most likely to see a large surge in bankruptcies this year. Junk bonds issued by retailers are performing dismally, and within the group the bonds of companies that were […]

DAX As Of April 21

Apr 22, 2017Jeremy Parkinson0

Only a fall below 11.850 will flash a yellow alert to this market. I see stops being there so a test of this area in the next sessions is on the table source: INVESTING.COM

EC You Are Not An Investor

Apr 22, 2017Jeremy Parkinson0

Giotto, Legend of St Francis, Exorcism of the Demons at Arezzo c.1297-1299 You are not an investor. One can only be an investor in functioning markets. There have been no functioning markets since at least 2008, and probably much longer. That’s when central banks started purchasing financial assets, for real, which means that is also […]

How The Recent Executive Order Could Change The US Commodity Sector

Apr 22, 2017Jeremy Parkinson0

Last week, a request from the Uranium Producers of America (‘UPA’) grabbed the headlines, as the organization was asking the US Department of Energy (DOE) to suspend the sale of (physical) uranium on the spot market. The UPA correctly described the status of the US based Uranium producers as ‘fragile’, and it’s pretty clear the […]

Oil’s Near-6% Drop May Pave The Path For Improving Fundamentals

Apr 22, 2017Jeremy Parkinson0

Fundamental Forecast forUSOIL: Neutral Talking Points: North American Oil Production at highest output levels since August 2015, per EIA Crude Oil Price Forecast: Downside Stalls on OPEC Favoring Extension Sentiment showing retail traders flipped to net-long favoring ST downside per contrarian effect Baker Hughes Rig Count Rises 5 Total to 688, 1 Added In Permian, […]