Goldman Sach’s Dubious Advice “Short Gold!”

Apr 07, 2016Jeremy Parkinson0

Those betting against Goldman Sach’s retail investment advice have generally been on the right side of things. The same thing is about to happen again. “Short gold! Sell gold!” said Goldman’s head commodity trader, Jeff Currie, during a CNBC “Power Lunch” interview. Currie’s advice was in response to the question “Is there any commodity you […]

A Dozen Reasons Why I Am Voting To Remain In The European Union

Apr 07, 2016Jeremy Parkinson0

I have studied the process of European integration in some detail at the College of Europe in Bruges where I also became a teaching assistant for a year. I also had the pleasure of doing my PhD thesis at the European University Institute in Florence. So it is probably no surprise that I would have […]

On The Fly: Pre-Market Movers Today

Apr 07, 2016Jeremy Parkinson0

Up After Earnings: Ollie’s Bargain Outlet Holdings (OLLI), up 9.9%… Bed Bath & Beyond (BBBY), up 2.8%… ConAgra Foods (CAG), up 1.1%… CarMax (KMX), up 3.2%. Lower: Twitter (TWTR), down 3% after Morgan Stanley cuts its price target on Twitter to $16 and maintains its Underweight rating… Alder Biopharmaceuticals (ALDR), down 3.5% after its 5.376M […]

Silver Price Forecast: The Interesting Relationship Between Silver Rallies And Interest Rates

Apr 07, 2016Jeremy Parkinson0

It is not well known, that historically silver and interest rates have actually moved together (in the long-term). When interest rates are going up, then silver is going up. When interest rates are going down, silver is going down. In the short-term, interest rates and silver can diverge (like since about 2002 to now); however, this is […]

Bottom Fishing For Value: Valeant Pharmaceuticals In Focus Today

Apr 07, 2016Jeremy Parkinson0

A bias for long ideas over short ones helped improve the ROI the bottom fishing for value strategy. Two areas that benefit the most from markets recovering include energy and biotech sectors. The newest long idea is a surprising one: Valeant Pharmaceuticals (VRX). The company restored some confidence from shareholders after it said it did […]

Time To Pick A Top In The Australian Dollar?

Apr 07, 2016Jeremy Parkinson0

The yen’s surge in recent days has captured the attention of investors and policymakers alike. It is indeed unsettling and seems to run counter to the economic logic negative interest rates, which the BOJ surprised the market with at the end of January. Yet, if one thinks the market has gotten ahead of itself, perhaps pickinga […]

Five ETFs To Buy For Q2

Apr 07, 2016Jeremy Parkinson0

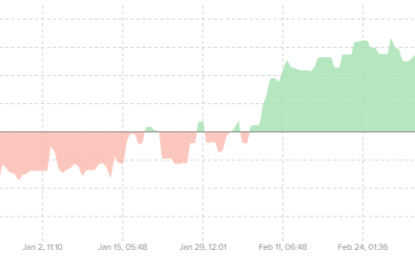

After a terrible start to the year, the U.S. stock market made a stunning comeback in the last six weeks of the first quarter. This is especially true as the major U.S. bourses recouped all the losses after falling more than 14% (as of February 11) from their recent peak levels. Notably, both the S&P […]

E Small Cap Best & Worst, Plus Q2 Seasonality

Apr 07, 2016Jeremy Parkinson0

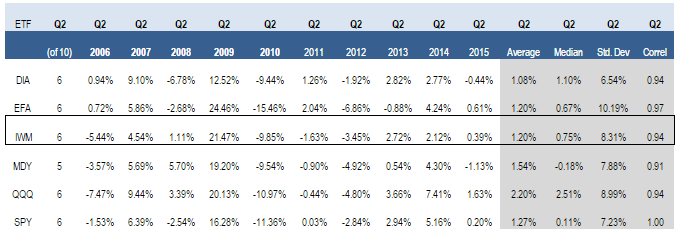

· The strongest small cap sectors are utilities and consumer goods. · The best small cap industry is general building materials. After rolling scores to reflect second quarter seasonality, the average small cap score is 50.44, which is below the four week average score of 51.62. The Russell 2k (IWM) offers pedestrian seasonality in Q2, gaining ground […]

The Stock Whisper Of The Day: GDX, USDU, CHL

Apr 07, 2016Jeremy Parkinson0

Hot stocks of the day: GDX, USDU, CHL Video length: 00:05:19

Does Not Compute: The Market Is The “Most Overbought Since 2009” Yet “Most Short Since 2008”

Apr 07, 2016Jeremy Parkinson0

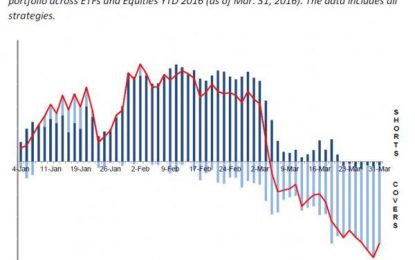

Earlier, we first reported something unexpected: when looking at the constituents of the record short squeeze that started two months ago, and still continues, traders had largely maintained kept single-name shorts, and instead covered short ETF exposure. This followed a previous observation showing that when it comes to NYSE short interest, it is near the […]