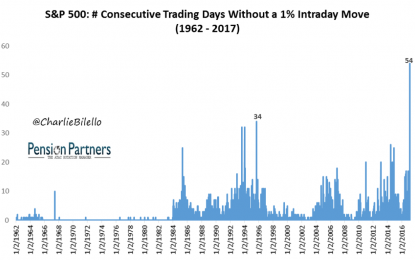

The Most Peaceful Market In History

Mar 06, 2017Jeremy Parkinson0

Investors on election night: “serenity now.” Investors today: “zzzzzz.” Since mid-December, we have witnessed the most peaceful market in history. The S&P 500 has now gone 54 consecutive trading days without a 1% intraday move (high to low as a %), trouncing the prior record of 34 straight days from back in 1995. When I […]

Long-term And Short-term Outlook For Oil

Mar 06, 2017Jeremy Parkinson0

My long-term outlook on oil hasn’t changed for more than a year. The long-term patterns are still bullish, despite the lack of movement in oil recently.The short-term outlook is a bit more bearish, as we could well see a move to the downside before the price continues higher. Currently, I am not positioned in oil futures, but […]

Global Oil Supply May Struggle To Match Demand After 2020 & Send Prices Sharply Higher

Mar 06, 2017Jeremy Parkinson0

Written by BNN.ca Global oil supply may struggle to match demand after 2020, when the pinch of a two-year decline in investment in new production could leave spare capacity at a 14-year low and send prices sharply higher, the International Energy Agency said on Monday. Investors generally are not betting on a sharp rise in the […]

The Biggest Myths In Investing, Part 7 – Fees Are A Small Price To Pay For Expert Advice

Mar 06, 2017Jeremy Parkinson0

<< Read More: The Biggest Myths In Investing, Part 1 – The “Investing” Myth << Read More: The Biggest Myths in Investing, Part 2 – The Stock Market Is Where You Get Rich << Read More: The Biggest Myths In Investing, Part 3 – You Need To Beat The Market << Read More: The Biggest Myths in Investing, Part […]

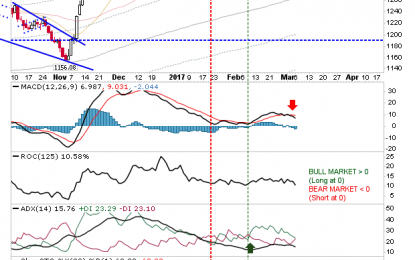

The Door Is Open, Will The Bears Take The Bait?

Mar 06, 2017Jeremy Parkinson0

After nearly 4 months of complacency, a few definitive signs of volatility may truly be emerging. The S&P 100 today opened with 95 decliners, first time we have seen this since early November. Moreover, the XLF sold off a bit today with bonds selling off as well. Lastly, we shall build a bullish spread in the […]

March 7th Daily Trading Opportunities

Mar 06, 2017Jeremy Parkinson0

During the session on Tuesday, we get GDP numbers coming out of the European Union, German Factory Orders, PMI numbers coming out of Canada, and several other mid-level announcements. Because of this, we could see a bit of volatility. DAX The German index fell a bit during the day on Monday, but continues to find […]

Status Quo

Mar 06, 2017Jeremy Parkinson0

There wasn’t a whole lot of change in markets with the Russell 2000 edging back to support. Small Caps remains the most vulnerable to an increase in profit taking with the 50-day MA playing as the last line of support. If there is a loss in such support watch for it to spread to other […]

Stocks And Precious Metals Charts – The Wind In The Wires Made A Tattle-tale Sound

Mar 06, 2017Jeremy Parkinson0

Stocks were off a bit for most of the day as traders continued to ‘digest’ the recent run up in equity prices that culminated in the SNAP IPO. As a reminder, there will be a Non-Farm Payrolls report this Friday for the month of February. The next week the markets fully expect the FOMC […]

Exports Only Matter Because They Let Us Import

Mar 06, 2017Jeremy Parkinson0

Among economics data watchers, a country’s exports enjoy a hallowed status. The ability of producers in country A to sell goods and services to people in other countries is taken as a sign of A’s economic strength, although the underlying metric for economic strength goes unmentioned. In addition, job counters across the spectrum constantly count […]

If You Believe There Was Too Much Money During The Monetary Panic, Then Why Not Heroin

Mar 06, 2017Jeremy Parkinson0

November 2008 was an extremely busy month for authorities in the US. The financial markets had just undergone panic the month before, but rather than dissipate there were lingering indications that all was not yet over. On November 23, 2008, the Treasury Department, the FDIC, and the Federal Reserve issued a joint statement on Citigroup. […]