EUR/USD Forex Signal For April 7, 2016

Apr 07, 2016Jeremy Parkinson0

EUR/USD Signal Update Yesterday’s signals may have triggered a long trade following the rejection of the identified support level of 1.1337. Today’s EUR/USD Signals Risk 0.75% Trades must be taken before 5pm London time today only. Long Trade 1 Long entry following a bullish price action reversal on the H1 time frame immediately upon the next […]

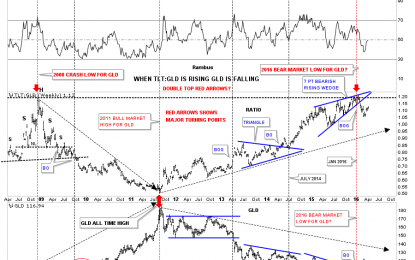

Gold Ratio Charts Revisited

Apr 07, 2016Jeremy Parkinson0

As the consolidation phase continues to build out from this first impulse move up in the precious metals sector lets review some of the charts we’ve looked at previously that suggested the bear market might be over. Most of these charts will be ratio charts which compare different sectors to one another. These rather complex charts can […]

Crude Oil – Nothing To Be Excited About

Apr 07, 2016Jeremy Parkinson0

US Weekly Crude Oil Inventories post a surprise drawdown as inventories fell 4.90 million in the week ending April 1st, 2016 Summary: Crude Oil extends strong gains on a surprise inventory drawdown April 17th marks the meeting between some OPEC and non-OPEC countries in Doha to discuss freeze production talks Iran is still the main […]

Ballast Point Continues To Perform For Constellation Brands

Apr 07, 2016Jeremy Parkinson0

Constellation Brands (STZ) shares reached an all time high after an excellent fourth quarter and raised guidance for 2017. Revenue came in at $1.54 billion, a 14.1% increase year-over-year. Constellation finished the year with $1.4 billion in operating cash flow an increase of 31%. Constellation has been on a roll recently with acquisitions, after completing its purchase […]

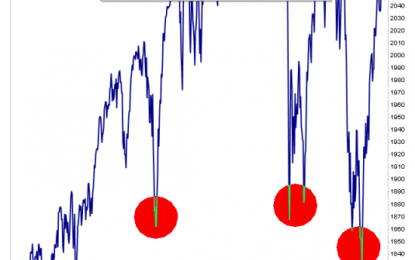

Roll Over Or Rally Hard?

Apr 06, 2016Jeremy Parkinson0

Several weekly and monthly indicators for the S&P 500 Index (SPX) are getting to levels that generally mark the top of bear market rallies. We’re sitting right at the point where the market will likely roll over or start an extremely sharp rally. First look at the weekly chart for SPX. RSI is just below […]

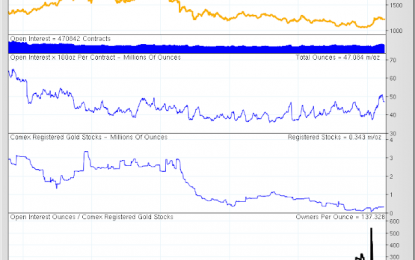

Gold And Silver ‘Owners Per Ounce’ Stress And Leverage

Apr 06, 2016Jeremy Parkinson0

Interesting that gold spiked almost shockingly, and has subsided from there, but is still much higher than it has been for the past twenty years. And now silver is spiking higher. These are not indications of a hard default, as some have suggested. Rather, when taken with other data from different sources it suggests that […]

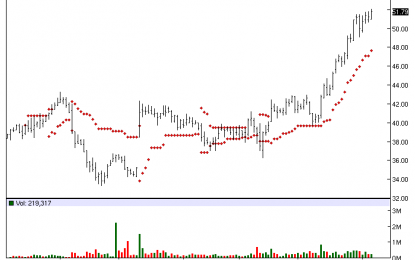

Seritage Growth Properties – Chart Of The Day

Apr 06, 2016Jeremy Parkinson0

The Chart of the Day belongs to Seritage Growth Properties (SRG). I found the REIT by using Barchart to sort the All Time High list first for the most frequent new highs in the last month then used the Flipchart feature to review the charts. Since the Trend Spotter signaled a buy on 2/17 the stock gained 25.20%. Seritage Growth Properties […]

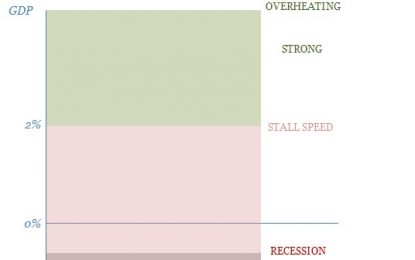

EC Presenting The Slowdown

Apr 06, 2016Jeremy Parkinson0

Whenever the topic of recession comes up, the mainstream and especially economists (redundant) become quite defensive about the possibility. Just a few days ago, presidential candidate Donald Trump claimed the US was headed for “a very massive recession” and that it was “a terrible time right now.” The Washington Post, as you would expect, was […]

SPX: Because… Reasons!

Apr 06, 2016Jeremy Parkinson0

As a market manager I stay calm about it and use it to the best of my ability. As a human I get annoyed by it and what it does to the average (present company I assume, excepted) market participant. In a bear market the best rallies last just long enough to get the trend […]

Bulls Buy The Dip

Apr 06, 2016Jeremy Parkinson0

Over the past couple of weeks the rate of buying has slowed. This slowing has become more pronounced as indices pushed into November/December consolidations, but today was a concerted effort to reverse this. The chief disappointment was the lighter volume which accompanied today’s buying for certain indices. The S&P still shows a relative underperformance against […]