Premarket Biotech Digest – CELG Inks New Deal, LLY Gets Favorable Ruling, ALR Modifies Deal

Jul 10, 2017

Jeremy Parkinson

Finance

Top Pick of the Day: CELG Celgene Corporation (CELG) announced that it has agreed to acquire a stake in BeiGene. The deal has valued BeiGene stock at $4.58 apiece. The company will buy 5.9 percent of the total stock, which would be 32.7 million shares. BeiGene is set to receive $263 million in upfront license […]

USD Strategy For Bullish And Bearish Scenarios As The Dollar Remains Near Lows

Jul 10, 2017

Jeremy Parkinson

Finance

This week is another big one for the U.S. Dollar, as the currency remains pinned-down near 10-month lows. The primary drivers for this week will likely come from Fed Chair Janet Yellen’s two-day testimony in front of Congress, set to take place on Wednesday and Thursday. During this twice-annual Humphrey Hawkins testimony, Chair Yellen will brief […]

Oil Dives (Again) As Hedge Funds Most Bullish In 3 Weeks

Jul 10, 2017

Jeremy Parkinson

Finance

On Sunday evening we wondered if news that Libya and Nigeria may soon be asked to cap output would serve as a catalyst for crude prices to start the week. Boom.. here’s your catalyst for oil on Monday: KUWAIT: OPEC, NON-OPEC TO DISCUSS OUTPUT CAPS ON LIBYA, NIGERIA — Walter White (@heisenbergrpt) July 9, 2017 […]

General Mills: Blue Chip Consumer Staples Stock Trading At Fair Value

Jul 10, 2017

Jeremy Parkinson

Finance

The consumer staples industry has a compelling value proposition for conservative investors. Why is this? The consumer staples sector has historically been one of the best-performing sectors of the stock market… …while also having the best recession performance. Traditional financial theory suggests that additional risk must be assumed to generate excess returns. The outperformance of the consumer […]

Euro/Dollar In Danger Of Falling Below 1.1380

Jul 10, 2017

Jeremy Parkinson

Finance

On Monday July 10, the US dollar index (DXY) is trading up thanks to Friday’s payrolls report. At the time of writing this review, the DXY is at 96.15 against a session high of 96.20. The euro/dollar rate has slid to 1.1382. The price is still within Friday’s range of 1.1380 – 1.1440. If the […]

Stocks Retrace Their Recent Weakness, New Uptrend?

Jul 10, 2017

Jeremy Parkinson

Finance

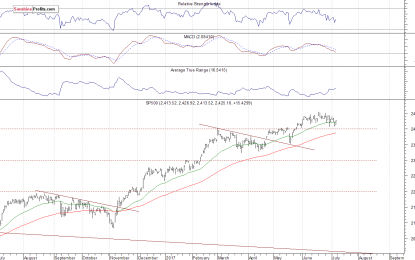

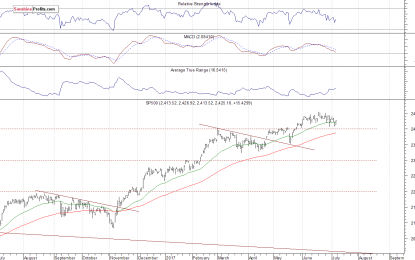

Our intraday outlook is bearish, and our short-term outlook is bearish. Our medium-term outlook remains neutral, following S&P 500 index breakout above last year’s all-time high: Intraday outlook (next 24 hours): bearish Short-term outlook (next 1-2 weeks): bearish Medium-term outlook (next 1-3 months): neutral Long-term outlook (next year): neutral The U.S. stock market indexes gained […]

Are Real Home Prices Rising Or Falling Where You Live: Here’s How To Find Out

Jul 10, 2017

Jeremy Parkinson

Finance

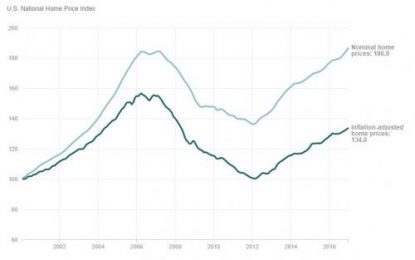

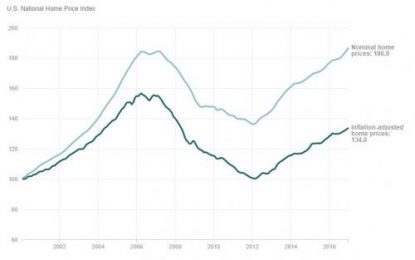

As we’ve noted time and time again, the fact that average national housing prices appear to have recovered from the peak of the housing bubble masks the uneven nature of America’s economic recovery: While certain popular coastal markets have seen prices recover, much of the south and Midwest have struggled with stagnation or even home-price deflation. Now, a new tabulation […]

Who Actually Holds Walmart’s Wealth?

Jul 10, 2017

Jeremy Parkinson

Finance

Who has the wealth of wealthy stockholders? The question seems absurd: the stockholders have it, of course. But I’m not asking who owns the stock; I’m asking who has the wealth? There is a difference. And the difference matters because many good people condemn the free market system on the mistaken belief that the wealth of the wealthy benefits only the wealthy. One […]

Back On Board: The Eurostoxx Bandwagon

Jul 10, 2017

Jeremy Parkinson

Finance

I was mad at myself for not exiting my long Eurostoxx position into Barron’s bullish cover article (Too Busy Patting Myself on the Back). At that point, we had hit maximum European enthusiasm, and the next move was bound to disappoint. And although it has barely been two weeks since I wrote that piece, I am […]

Stocks: Thunder Dome

Jul 10, 2017

Jeremy Parkinson

Finance

Well, a full week is upon us, and we enter a period in which we don’t have any damned holidays to interrupt our trading until September rolls around. Looking at the ES, the topping formation is still in the throes of completion. Simply stated, the steady series of lower lows and lower highs must not be violated, and […]