European stocks rebounded after the biggest one-day drop since November, alongside S&P futures, while Asian equities posted modest declines after yesterday’s weak US close. Gold and yen slid, while the dollar gained on the latest Mnuchin comments to the FT according to which Trump was “absolutely not” trying to talk down the dollar.

European equities rose 0.4% in early trading, hinting at some cautious optimism following a day of risk off sentiment, and reversing the 0.6% fall in Asian equities outside Japan which dipped to a one-month low.U.K. shares initially traded lower as the pound held much of its gains following the surprise election announcement, however have since rebounded back to unchanged. Having dragged it lower on Tuesday after another major rout in China, commodity companies helped prop the Stoxx Europe 600 Index, which rebounded following the biggest one-day loss since November. Sterling pulled back slightly after reaching the strongest level since October on Tuesday. Oil fluctuated after dipping on yesterday’s API data which showed U.S. oil inventories fell 840,000 barrels last week, a lower than expected draw. On Wednesday official EIA data is expected to show a larger drop of 1.4 million barrels.

“Sterling rallied across the board yesterday on the back of Prime Minister May’s announcement of snap UK elections. The market interpreted the move as an effort to strengthen the prime minister’s majority and reinforce a more unified stance for the upcoming negotiations with the EU,” Unicredit analysts said in a note on Wednesday. “Geopolitical tensions are providing strong support to U.S. Treasuries … (and) in the euro zone Bunds are receiving support from the general decline in risk appetite and uncertainty related to the French presidential election.”

The flight to Treasury safety pushed JGB yields briefly back into the negative overnight, however modest selling in the complex has since seen the 10Y yield rebound back over 0.00%

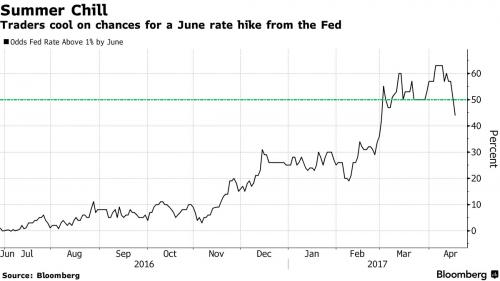

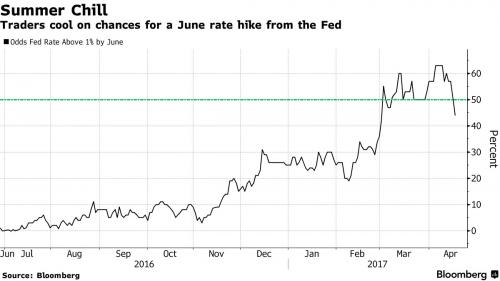

As Bloomberg highlights in its overnight wrap, after declines on Tuesday, investors seem to be taking the addition of yet another macro risk in their stride. The U.K. vote joins a slew of elections to be held this year against a backdrop of rising populism in the Europe, while geopolitical tensions are simmering over both North Korea and Syria and the pace of monetary tightening in the world’s biggest economy looks uncertain. Meanwhile, the reflation trade has soured, with June rate hike odds dropping below 50% for the first time in two months.

Asian shares failed to benefit from the eventual rebound in risk sentiment, and the Shanghai Composite Index fell 0.8%, taking its four-day loss to 3.2%. The main Shenzhen market was also down a fourth day. The Hang Seng Index slid 0.4 percent and the Hang Seng China Enterprises Index dropped below the 10,000 level for the first time in two months. Japan’s Topix index was little changed, while Australia’s S&P/ASX 200 Index lost 0.6 percent and South Korea’s Kospi index fell 0.5 percent.

Risk was firmer in Europe,where the Stoxx Europe 600 increased 0.3% as of 10:10 a.m. in London, after dropping 1.1% on Tuesday.

In the US, S&P futures rose 0.3% offsetting yesterday’s 0.3% drop in the cash market. IBM slumped in after-hours U.S. trading after its 20th consecutive quarterly sales decline.

Sterling was just off a six-month peak against the dollar above $1.28 having surged when British Prime Minister Theresa May called an early general election for June 8, seeking to strengthen her party’s majority ahead of Brexit negotiations.

The dollar was undermined in part by an eroding interest rate advantage as U.S. bond yields dived to five-month lows. Yields on 10-year Treasury paper sank to 2.17%, far away from the 2.629% peak seen in March. They were last up slightly on the day at 2.20%.

A run of disappointing U.S. economic data and doubts that the Trump administration will progress with tax cuts have quelled expectations of faster inflation and boosted fixed-income debt. That, in turn, has taken the steam out of Wall Street. The Dow fell 0.55 percent on Tuesday, while the S&P 500 lost 0.29 percent and the Nasdaq 0.12 percent. Goldman Sachs lost 4.7 percent in the largest daily drop since June after its earnings missed expectations as trading revenue dropped.

In commodity markets, profit taking nudged gold down 0.4 percent to $1,287.10 an ounce, and away from Monday’s peak of $1,295.42. Oil prices slipped as U.S. crude stockpiles fell by less than expected and a U.S. government report said shale oil output in May was likely to post the biggest monthly increase in more than two years

Economic data include weekly mortgage applications. Scheduled earnings include U.S. Bancorp, Qualcomm, Morgan Stanley.

Bulletin Overnight Summary from RanSquawl

Global Market Snapshot