Written by Ben Carlson (awealthofcommonsense.com)

When the dollar is strong, U.S. stocks tend to outperform international equities and, when the dollar is weak, international stocks tend to outperform. (This is all from the perspective of a U.S.-based investor. These relationships would be reversed for a foreign investor in U.S. stocks.) Let’s take a look at an example to see how this has played out over the past 20-plus years.

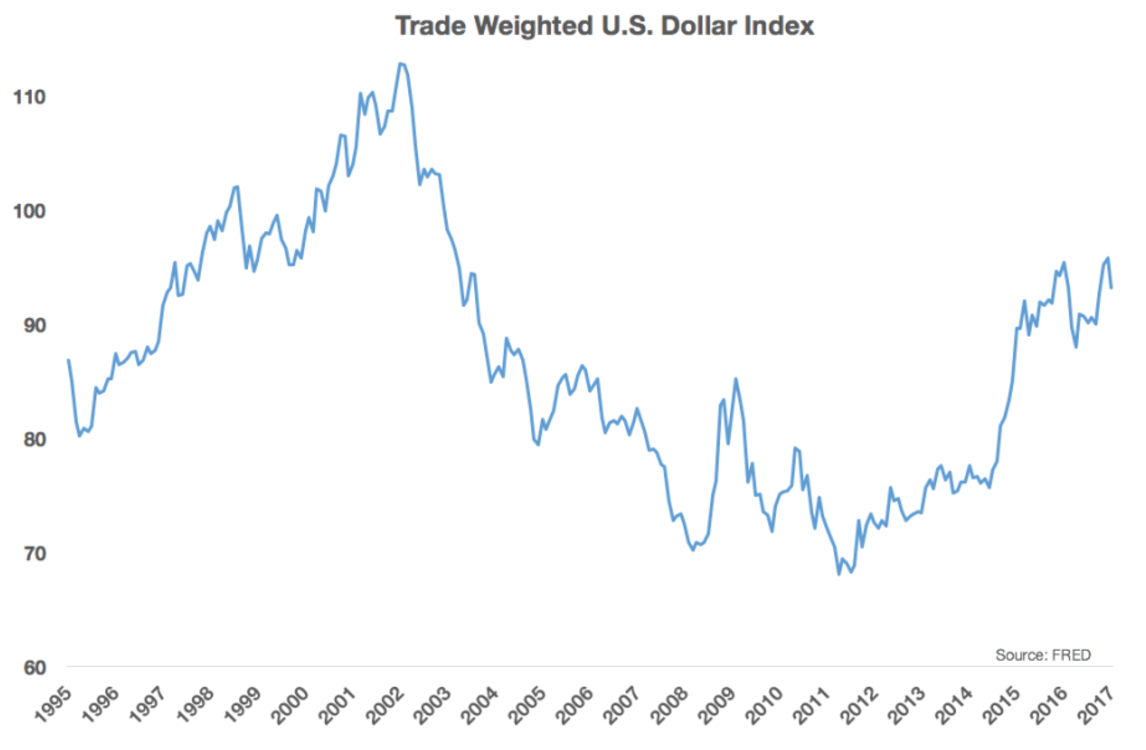

In the chart below…you can see a graph of the trade-weighted U.S. dollar index since the mid-1990s:

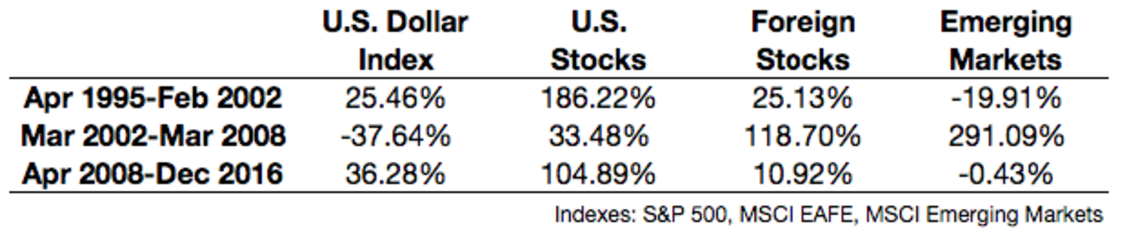

The dollar rose from the mid-1990s through the early 2000s. It then reversed course and gave back those gains – and then some – before bottoming out in the aftermath of the financial crisis. It has been rising ever since. The impact on stock markets around the globe during these dollar regimes is stark:

A strong dollar propelled U.S. stocks to huge absolute and relative outperformance starting in the mid-1990s and once again starting during the financial crisis. When the dollar fell during the mid-2000s, we saw this relationship reverse. The most heavily affected countries have been the emerging markets, which makes sense considering how strongly their economies and currencies are to movements in the dollar.

A stronger dollar tends to lead to weaker sales overseas and a weaker dollar tends to lead to stronger sales overseas so, when the dollar is weak you can expect international stocks to outperform U.S. equities. That’s because foreign currencies will be appreciating, meaning your investments in those countries will get more bang for the buck in terms of earnings and dividends. The opposite is true with a strengthening dollar. A large percentage of S&P 500 revenue comes from overseas these days so it’s true that fluctuating currencies could also impact multinational corporate results.

Investors also have to remember that while currencies can fluctuate wildly from country to country in the short- to intermediate-term, these differences tend to cancel each other out over the long-term. Since 1995, the U.S. Dollar Index has basically gone nowhere, up just 4% over this time. This means that investing in international stocks can provide greater diversification benefits to a portfolio for investors who are willing to be patient.