Why Are Exchange-Traded Funds Preparing For A ‘Liquidity Crisis’ And A ‘Market Meltdown’?

May 13, 2015

Jeremy Parkinson

Finance

Some really weird things are happening in the financial world right now. If you go back to 2008, there was lots of turmoil bubbling just underneath the surface during the months leading up to the great stock market crash in the second half of that year. When Lehman Brothers finally did collapse, it was a […]

Cisco Efficiency Shines Through Q3 Earnings

May 13, 2015

Jeremy Parkinson

Finance

Tech behemoth and Dow component Cisco Systems (CSCO – Analyst Report) reported earnings results after the bell Wednesday, and met earnings estimates once again. Cisco brought in 48 cents per share (accounting for stock-based compensation) on fiscal Q3 revenues of $12.14 billion. The Zacks Consensus Estimates expected 48 cents per share and $12.06 billion in sales. In […]

Surging Solar Industry & Low Production May Boost Silver

May 13, 2015

Jeremy Parkinson

Finance

The use of silver in emerging technologies, particularly solar energy production, sets the stage for surging demand and rapidly rising silver prices in the future. That means the silver market provides some great opportunities for investors. According to a report in The Telegraph, analysts expect the demand for solar energy to increase 30% in 2015 alone. […]

5 Terrific Small Caps

May 13, 2015

Jeremy Parkinson

Finance

Each week Value Line publishes a list of the 400 Small and Mid Cap stocks they feel have the best chance of relative price appreciation from the 3800 stocks in their data base. I have run these 400 through the Barchart technical indicators to find the stocks with the highest technical buy signals. Today’s list […]

Facebook Stock Retracement Pattern

May 13, 2015

Jeremy Parkinson

Finance

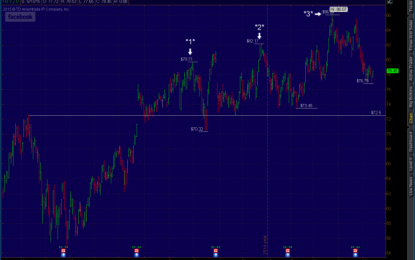

Facebook (FB) stock price has been in decline since the company reported it’s 1st quarter 2015 earnings results, even though results handily beat the bottom line consensus expectations. Turns out this is not usual price action and might even signal support has been, or close to being, reached. The chart above shows the last two […]

No Small Thing – Financial Review

May 13, 2015

Jeremy Parkinson

Finance

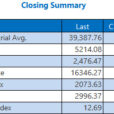

Podcast: Play in new window | Play in new window (Duration: 13:16 — 6.1MB) DOW – 7 = 18,060 SPX – 0.64 = 2098 NAS + 5 = 4981 10 YR YLD + .02 = 2.28% OIL – .62 = 60.13 GOLD + 22.10 = 1216.10 SILV + .61 = 17.19 U.S. retail sales were flat in April. Americans went […]

Range Bound Trading

May 13, 2015

Jeremy Parkinson

Finance

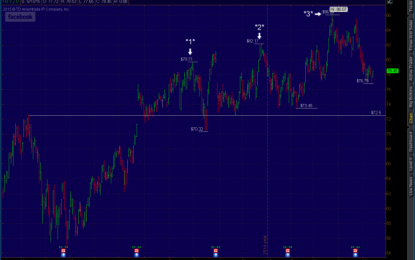

Yesterday’s recovery followed with further highs, but then buyers went AWOL and things settled back to the day’s lows. Rinse and Repeat. The S&P has nestled itself against rising trendline support as today’s action registered as confirmed distribution. Tomorrow, bears will be seeing if they can break the trendline, but I won’t be holding my […]

King Digital Isn’t The One Hit Wonder You Think It Is

May 13, 2015

Jeremy Parkinson

Finance

King Digital (KING) is set to report first quarter earnings Thursday after the closing bell. The latest installment in King’s flagship franchise, Candy Crush, has performed well resulting in 2 large earnings beats. Even though the new game has been a success in the sense that it’s helped the company top analyst expectations, fundamental growth […]

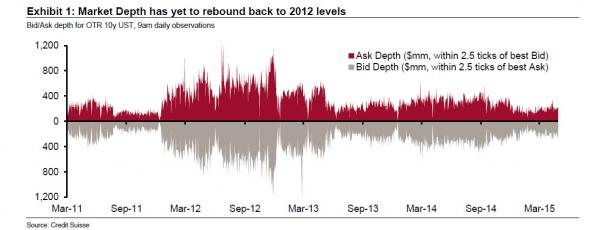

The History Of Treasury Market Liquidity (And Lack Thereof) In One Chart

May 13, 2015

Jeremy Parkinson

Finance

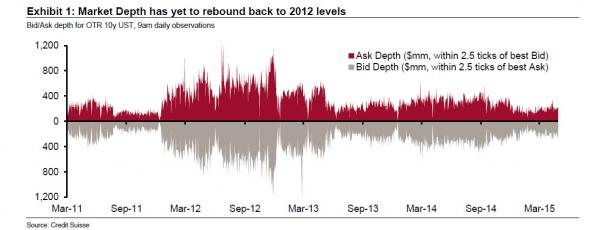

While we completely disagree with Credit Suisse about the reasons for the total collapse in bond market liquidity (as readers know we blame the Fed – as does the TBAC – and HFTs, while Credit Suisse accuses regulations, even though banks now hold a record amount of fungible bonds implying that unless bank prop desks […]

Shake Shack (SHAK) Shares Are Sizzling Hot After Beating Q1 Estimates

May 13, 2015

Jeremy Parkinson

Finance

At the end of Q1, popular burger joint Shake Shack Inc (SHAK – Snapshot Report) silences its critics by beating estimates on all fronts. Earned $0.04 per share and reported revenue of $37.8 million, compared to Wall Street’s estimates of $0.03 per share and revenue of $33.95 million. Shack sales increased 59.2% to $36 million, […]