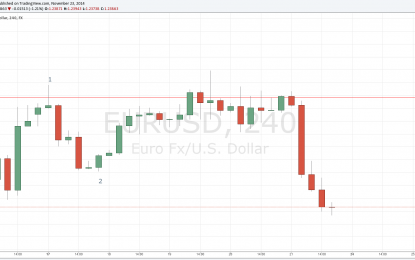

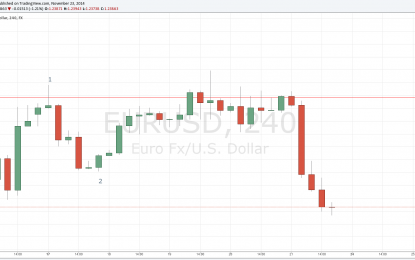

Last Week Support / Resistance Trades 23 November 2014 – EUR/USD, EUR/JPY

Nov 23, 2014

Jeremy Parkinson

Entertainment

We had expected the level at 1.2557 might act as resistance as it had acted previously as both resistance and support. Note how these “flipping” levels can work really well. The H4 chart below shows how the price printed a bearish pin bar with a bounce off this level just before Monday’s London session, shown […]

Alipay And Taobao Expand In Australia, Helping Local Businesses Reach China

Nov 23, 2014

Jeremy Parkinson

Entertainment

Photo Credit: Shutterstock, Flags of China and Commonwealth of Australia As a part of its global expansion, Alibaba (BABA) announced today that both its payment affiliate Alipay and Taobao marketplace are committed to bringing Australian products, brands and businesses closer to Chinese customers. This move is expected to boost Chinese consumption of Australian products […]

Low Risk High Reward Trading And Investing

Nov 23, 2014

Jeremy Parkinson

Entertainment

by Sam Seiden, Online Trading Academy As the old saying goes, “risk and reward go hand in hand.” I can’t tell you how many times I have heard that in the trading and investing world. Most people think the more reward you try to attain, the more risk you need to take on. Many years ago, […]

The State Of The World FOREX

Nov 22, 2014

Jeremy Parkinson

Entertainment

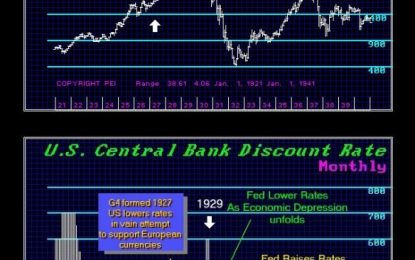

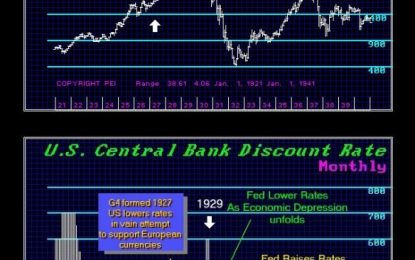

While recession has returned to Japan and interest rates have dropped to negative, in Europe the ECM has effectively announced it will expand its balance sheet again by a trillion Euro. China has lowered interest rates showing this view of lowering interest rates is believed to stimulate the economy still prevails, albeit nobody can point […]

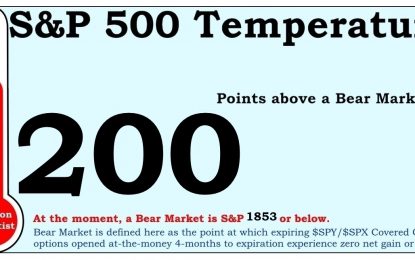

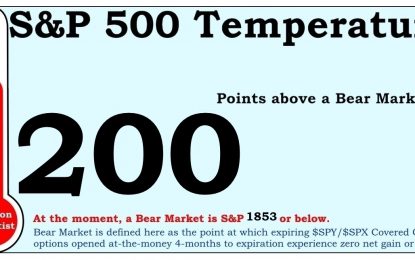

S&P 500 Stretched Like A Spring

Nov 22, 2014

Jeremy Parkinson

Entertainment

Stock prices tend to act like a spring. The further they are stretched to their limits, the further they tend to snap back in the opposite direction. The opposite is also true. When stock prices are not stretched very far, they don’t recoil nearly s far in the opposite direction when the stretching force is […]

ECRI Recession Watch: Weekly Update

Nov 22, 2014

Jeremy Parkinson

Entertainment

The Weekly Leading Index (WLI) of the Economic Cycle Research Institute (ECRI) is at 133.2, up from the previous week’s 132.0. The WLI annualized growth indicator (WLIg) is at -2.4, down from -2.9 the previous week. ECRI has been at the center of a prolonged controversy since publicizing its recession call on September 30, 2011. […]

On The Looming Wall Of Chinese Defaults, Restructuring Firm Warns “You Know It’s Coming”

Nov 22, 2014

Jeremy Parkinson

Entertainment

The news this week of China’s largest corporate bankruptcy – Haixin Iron & Steel Group – amid crashing iron ore and steel prices was followed by analysts noting it “will be followed by others,” as the major flaw of producers of iron ore, the most traded commodity after oil, is they tend to be “over-bullish.” […]

Can Technology Save Chocolate?

Nov 22, 2014

Jeremy Parkinson

Entertainment

If you haven’t already heard, the world is facing a chocolate shortage. Part of the reason is increased demand, as Chinese taste buds awaken to the delicious treat. But part of the reason is climate change. Cacao is a fickle plant. The trees grow in shady areas of rainforests within 20 degrees of the Equator. They […]

The View From Far Above

Nov 22, 2014

Jeremy Parkinson

Entertainment

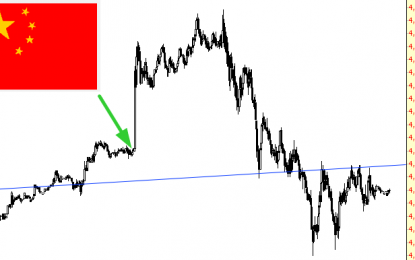

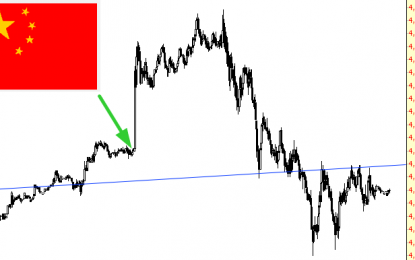

As the entire world knows by now, China joined the rest of the world’s central banks in more “easing”, which sent markets into a spastic move higher. As you can see by this view of the NQ, this massively bullish news has not, as of yet, represented any kind of sea-change in the markets. Before […]

4 Things Long-Term Investors Should Never Say

Nov 22, 2014

Jeremy Parkinson

Entertainment

More than half of all American adults have investments in the stock market. Yet the average investor tends to underperform major market indices on timelines ranging from one year to more than two decades. How can this be? Some of this underperformance is due to the fact that many investors just don’t have enough resources […]