Market Commentary: DOW, SP500 Make New Highs On Heavy Volume

Nov 21, 2014

Jeremy Parkinson

Entertainment

Written by Gary Premarkets were up +0.8% this morning with noticeable volume which translated into a gap up at the opening. Markets opened in the +0.8% range on high volume setting new historic highs for the DOW and the SP500. By 10 am the Nasdaq was within 10% of its historic highs set in 2000 and […]

Marvell Beats On Q3 Earnings Estimates, Issues Q4 Guidance

Nov 21, 2014

Jeremy Parkinson

Entertainment

Marvell Technology Group (MRVL – Snapshot Report) reported third-quarter fiscal 2015 adjusted earnings (including stock-based compensation but excluding amortization, acquisition, restructuring and legal related expenses) of 23 cents per share, which beat the Zacks Consensus Estimate of 22 cents. Earnings declined both sequentially and year over year, mainly because the company adjusted tax benefits in both historical periods. […]

5 Things To Ponder: Rising Risk

Nov 21, 2014

Jeremy Parkinson

Entertainment

There are things going on with the financial markets currently that seem just a bit “out of balance.” For example, asset prices are rising against a backdrop of global weakness, deflationary pressures and rising valuations. More importantly, there is a rising divergence between sentiment and hard data. For example, on Thursday the Philadelphia Federal Reserve released their […]

Questions On Gold

Nov 21, 2014

Jeremy Parkinson

Entertainment

#1 QUESTION: Mr. Armstrong, do fundamentals really matter? It seems like the commentators can focus on whatever they want flipping it bullish or bearish based upon their views at that moment. Thanks for all you do MK #2 QUESTION: Hi Martin, Thank you for all that you do. I have truly been enlightened to the gold […]

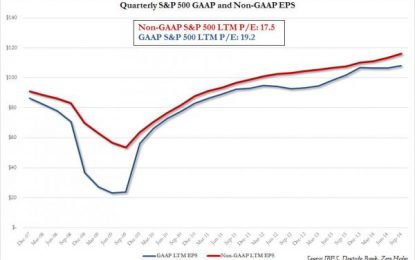

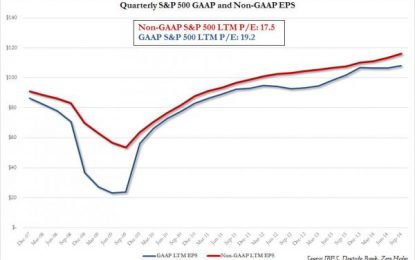

The S&P’s GAAP P/E Ratio Rises Above 19X

Nov 21, 2014

Jeremy Parkinson

Entertainment

Goldman may have been right that there will be no more multiple expansion in 2015, but there sure was quite a bit overnight thanks to the latest verbal and actual central bank interventions by the ECB and the PBOC. And as a result, the biggest beneficiary is the S&P500, which is set to open just around […]

Gap (GPS) Misses On Q3 Earnings And Sales, Shares Drop

Nov 21, 2014

Jeremy Parkinson

Entertainment

Shares of The Gap, Inc. (GPS – Analyst Report) dropped 3.7% in the after market trading session yesterday, as the company’s third-quarter fiscal 2014 adjusted earnings of 74 cents a share missed the Zacks Consensus Estimate of 79 cents. However, earnings improved 2.7% on a year-over-year basis. Including a 6 cents per share gain from a non-recurring tax benefit […]

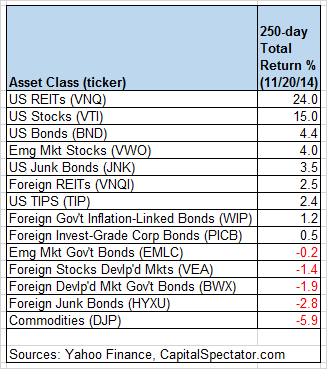

Markets Review, 21 November 2014

Nov 21, 2014

Jeremy Parkinson

Entertainment

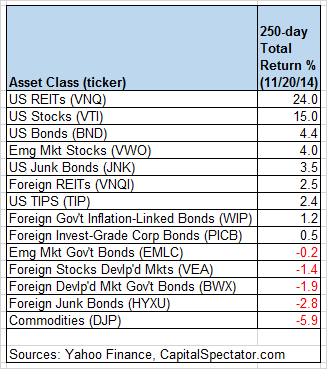

In the horse race among the major asset classes, there’s not much competition for first place at the moment. US REITs remain in the lead for the trailing one-year period (250 trading days), and by a wide margin, based on our standard list of ETF proxies for the key slices of global markets. In other words, US […]

Draghi Speaks The Truth: ECB Will Do What It Must

Nov 21, 2014

Jeremy Parkinson

Entertainment

This is a duplicate post. Please see original at http://www.talkmarkets.com/content/us-markets/draghi-speaks-the-truth?post=53368

Draghi Speaks The Truth

Nov 21, 2014

Jeremy Parkinson

Entertainment

Draghi Speaks the Truth; ECB Will ‘Do What it Must’ Words are important. This is not just a headline, it is a reality… Draghi says ECB will ‘do what it must’ on asset buying to lift inflation Not ‘do what it thinks would be the best course for the European economy’, not ‘choose the path of least […]

ASA And Gallup Indicate Continued Jobs Gains

Nov 21, 2014

Jeremy Parkinson

Entertainment

The ASA temp staffing index hit 105.1 last week just short of an alltime high of 105.2. Typically this index peaks the first or second week into December which means we are all but assured of hitting all time records in a few weeks. Both these indexes coinciding like this bodes very well for continued […]