Currency Misalignment: A Reprise

May 15, 2015

Jeremy Parkinson

Finance

As the Congress debates currency manipulation [1], it occurs to me useful to reprise my earlier primer on currency misalignment (first published in March 2010), where misalignment is one component of some definitions of currency manipulation. Currency misalignment can be determined on the basis of the following criteria or models: Relative purchasing power parity (PPP) Absolute purchasing power […]

Semiconductor M&A Heating Up: 3 Stocks To Watch

May 15, 2015

Jeremy Parkinson

Finance

Consolidation in the semiconductor sector has increased over the last few years, but that hasn’t really caught our attention because the size of deals was small — so small, in fact, that the acquirers were not even required to furnish too many details. There are several advantages to small deals: they have cheaper valuations, don’t […]

![Am I Investing Or Speculating…?]()

Am I Investing Or Speculating…?

May 15, 2015

Jeremy Parkinson

Finance

“An investment operation is one which, upon thorough analysis, promises safety of principal and an adequate return. Operations not meeting these requirements are speculative. “ Benjamin Graham The year was 2008, I was 25 years old at a Thanksgiving dinner with some family and friends. If you remember 2008 was the year the “Great Recession” […]

Empire State Manufacturing Weaker Than Economists’ Expectations

May 15, 2015

Jeremy Parkinson

Finance

The Empire State Manufacturing survey came in today weaker than the Bloomberg Consensus Estimate, but at least the economists got the leading +- sign correct. The first indication on May conditions in the manufacturing sector is soft, as indications have been all year. The Empire State index came in at 3.09, below what were already weak […]

Lower Earnings, Higher Stock Prices: The Voting Machine

May 15, 2015

Jeremy Parkinson

Finance

“The stock market is a voting machine rather than a weighing machine. It responds to factual data not directly, but only as they affect the decisions of buyers and sellers.”- Graham and Dodd, Security Analysis Earnings drive stock prices, so says investing lore. As earnings rise, stock prices move higher. As earnings fall, stock prices move […]

April 2015 Industrial Production: Weak Data Continues

May 15, 2015

Jeremy Parkinson

Finance

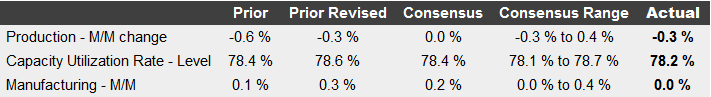

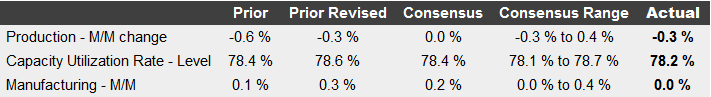

The headlines say seasonally adjusted Industrial Production (IP) declined. This month the manufacturing portion of this index was unchanged month-over-month – but the other portions of industrial production declined. This is another weak report, and again under expectations. Headline seasonally adjusted Industrial Production (IP) decreased 0.3% month-over-month and up 1.9% year-over-year. Econintersect‘s analysis using the unadjusted data is that […]

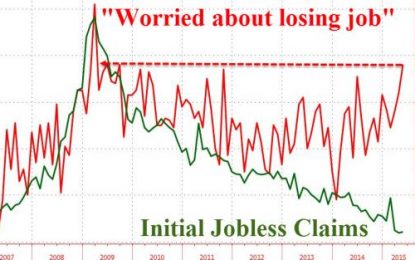

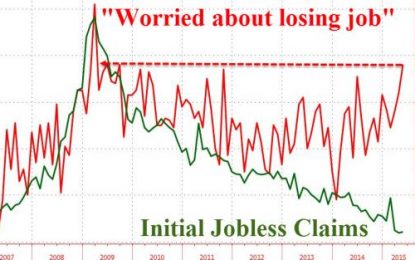

Someone Is Lying: Job Optimism Plummets To Levels Unseen Since Financial Crisis

May 15, 2015

Jeremy Parkinson

Finance

The percentage of respondents to University of Michigan’s Consumer Sentiment Survey that “think they (or their spouse) will lose their job over the next 5 years” soared to its highest since March 2009. Either the BLS’ workers are lying, or the government’s data on jobs is ‘misleading’ According to UMich Curtin: CURTIN: TRADE GAP’S INFLUENCE ON […]

5 Things To Ponder: Reading While Waiting List

May 15, 2015

Jeremy Parkinson

Finance

This past week has been much the same as the last couple of months – boring. It has been more interesting trying to count carpet fibers in my office than watching the markets. However, there has been some excitement in domestic bond yields that have SURGED over the last couple of weeks. Well, as I […]

Industrial Production, Down 5th Month, Weaker Than Economist Expectations

May 15, 2015

Jeremy Parkinson

Finance

Industrial production came in at -0.3%, down for the fifth consecutive month below the Bloomberg Consensus Estimate. Industrial production is stalling, down 0.3 percent in April for a 5th straight monthly contraction. Factories are cutting back with capacity utilization down 4 tenths to 78.2 percent. And the manufacturing component, which has been flat to negative […]

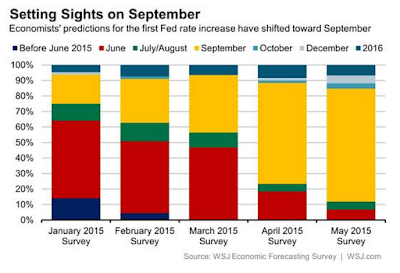

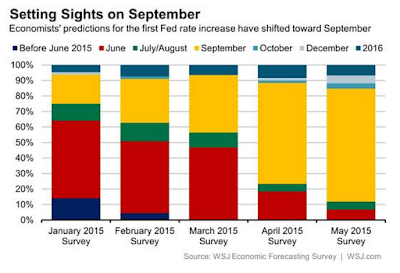

Great Graphic: Expectations For Lift-Off Solidify For September

May 15, 2015

Jeremy Parkinson

Finance

This Great Graphic comes from the Wall Street Journal. It shows the evolution of market expectations for the first Fed rate hike from the monthly survey it conducts. At the start of the year, many economists, like ourselves, thought that a June hike was the most likely scenario. However, the weakness of Q1, and especially the poor job growth […]