ECRI Recession Watch: Weekly Update

Nov 22, 2014

Jeremy Parkinson

Entertainment

The Weekly Leading Index (WLI) of the Economic Cycle Research Institute (ECRI) is at 133.2, up from the previous week’s 132.0. The WLI annualized growth indicator (WLIg) is at -2.4, down from -2.9 the previous week. ECRI has been at the center of a prolonged controversy since publicizing its recession call on September 30, 2011. […]

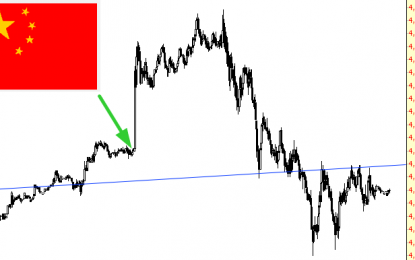

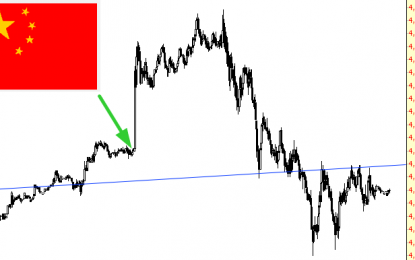

On The Looming Wall Of Chinese Defaults, Restructuring Firm Warns “You Know It’s Coming”

Nov 22, 2014

Jeremy Parkinson

Entertainment

The news this week of China’s largest corporate bankruptcy – Haixin Iron & Steel Group – amid crashing iron ore and steel prices was followed by analysts noting it “will be followed by others,” as the major flaw of producers of iron ore, the most traded commodity after oil, is they tend to be “over-bullish.” […]

Can Technology Save Chocolate?

Nov 22, 2014

Jeremy Parkinson

Entertainment

If you haven’t already heard, the world is facing a chocolate shortage. Part of the reason is increased demand, as Chinese taste buds awaken to the delicious treat. But part of the reason is climate change. Cacao is a fickle plant. The trees grow in shady areas of rainforests within 20 degrees of the Equator. They […]

The View From Far Above

Nov 22, 2014

Jeremy Parkinson

Entertainment

As the entire world knows by now, China joined the rest of the world’s central banks in more “easing”, which sent markets into a spastic move higher. As you can see by this view of the NQ, this massively bullish news has not, as of yet, represented any kind of sea-change in the markets. Before […]

4 Things Long-Term Investors Should Never Say

Nov 22, 2014

Jeremy Parkinson

Entertainment

More than half of all American adults have investments in the stock market. Yet the average investor tends to underperform major market indices on timelines ranging from one year to more than two decades. How can this be? Some of this underperformance is due to the fact that many investors just don’t have enough resources […]

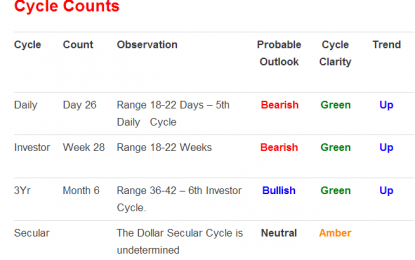

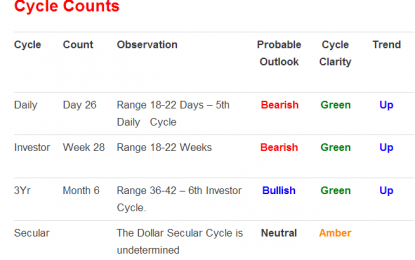

The US Dollar Remains Stubbornly Bullish

Nov 22, 2014

Jeremy Parkinson

Entertainment

The Dollar stubbornly refuses to fall, even though it too (like crude/bonds) is very deep into its Daily and Investor Cycle timing. Technically it is weakening, as seen within the indicators on the chart below. I believe this is a sign that the dollar has topped and is about to begin falling. When it eventually […]

Thanksgiving Top Trades Review – Using Options To Reduce Risk And Increase Profits

Nov 22, 2014

Jeremy Parkinson

Entertainment

Happy Thanksgiving (almost)! We added a new feature last month called Top Trades™ (Members Only) so I thought it would be a good time to see how we’re doing as well as give a few tricks and tips to our new subscribers. Top Trade Alerts are sent out once or twice a week via […]

Everyone Wants Dollars (Again)

Nov 22, 2014

Jeremy Parkinson

Entertainment

A new phase in the markets began this month. The Federal Reserve ended its QE3+ purchases. The Bank of Japan unexpectedly and dramatically stepped up its asset purchases under its QQE operations. The government’s largest pension fund announced aggressive portfolio diversification plan. Contrary to some press reports, the ECB remained unanimous in favor of additional […]

Is There A Rental Shortage – Inflation Threat?

Nov 22, 2014

Jeremy Parkinson

Entertainment

There is an obvious relationship between supply and demand. In the rental housing market, demand is eroding supply at a rapid rate according to recent data – likely due to changing demographics and preferences. The Consumer Price Index (CPI) is based 40% on housing costs – so the logical conclusion is that a rapid rise […]

Oil And Currency Markets Reflect Expectations For Lower Global Economic Growth

Nov 22, 2014

Jeremy Parkinson

Entertainment

by James Preciado and Jeff Baron , U.S. EIA Since August, both crude oil and currency markets have been influenced by lower economic growth expectations in countries outside the United States. Prices in both markets recently broke out of established trading ranges, driven by concerns about weaker future global demand. The current situation, with the dollar index […]