Lagging Long Yields

Nov 23, 2014

Jeremy Parkinson

Entertainment

I’m a very intellectually curious person — I could spend most of my time researching investing questions if I had the resources to do that and that alone. This post at the blog will be a little more wonky than most. If you don’t like reading about bonds, Fed Policy, etc., you can skip down […]

Interview: AOL On Going Global, Its Rumored Merger With Yahoo, Emerging Markets & More

Nov 23, 2014

Jeremy Parkinson

Entertainment

While AOL is mostly known for it’s presence and dominance in the US market, trends in the last few years have taken the company across the ocean with global acquisitions throughout Europe and Asia. Earlier this month, Bill Pence, AOL’s CTO came to Israel to promote the company’s new initiative for university relations and its newly formed […]

Politics Is Economics In The Week Ahead

Nov 23, 2014

Jeremy Parkinson

Entertainment

Many people assume that politics and economics are separate spheres. We find ourselves often harkening back to the even older tradition of referring to “political economy”. After all it was Harold Laswell, who is regarded as the father of modern political science, that famously defined politics as who gets what, when and how. Isn’t that […]

Dividend Investors Should Focus On Stocks, Not The Market

Nov 23, 2014

Jeremy Parkinson

Entertainment

The election may be settled, but investors’ fears are not. When Barack Obama was first elected, the market plunged on worries of the looming Fiscal Cliff and European concerns. Budget negotiations began on Capitol Hill, optimism returned and the market responded. More recently, Obama’s popularity plunged, then the Republicans regained control of the Senate. Is it a […]

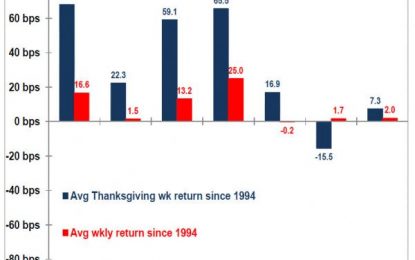

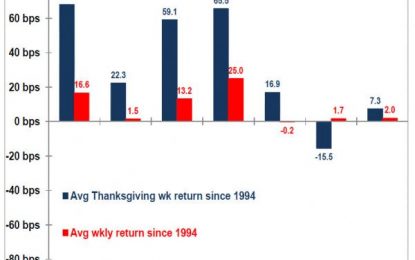

The Best And Worst Performing Assets During Thanksgiving Week

Nov 23, 2014

Jeremy Parkinson

Entertainment

While technicals remain largely meaningless in the global centrally-planned “USSR market” (as penned by Russell Napier, who asked “Which World Has No Volume, No Volatility And Rising Prices?”, his answer: the USSR), pattern-seeking carbon-based traders still find refuge in the comfort provided by technical analysis. So for all those who believe past performance is indicative of future results, here […]

Report: Amazon Plans To Launch Travel Service, Hotel Booking

Nov 23, 2014

Jeremy Parkinson

Entertainment

Skift is reporting that Amazon (AMZN) is poised to launch its own travel service, featuring booking at independent hotels and resorts near major cities. The initial rollout of Amazon Travel would feature a curated selection of hotels within a few hours’ drive from New York, Los Angeles, and Seattle. The service will likely go live around January 1. […]

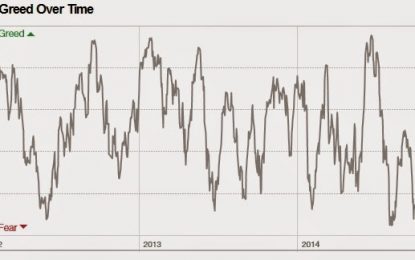

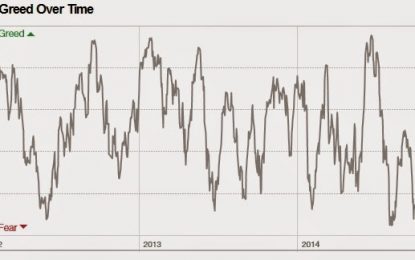

Weighing The Week Ahead: Are Investors Too Complacent?

Nov 23, 2014

Jeremy Parkinson

Entertainment

The upcoming calendar has plenty of data in a holiday-shortened week. There could be OPEC, or Black Friday news. In spite of this avalanche of information, I expect commentators to look for an organizing principle. In a week when many will be giving thanks, there will be scrutiny of the new market highs. Many will […]

How To Find The Best Sector ETFs

Nov 23, 2014

Jeremy Parkinson

Entertainment

Finding the best ETFs is an increasingly difficult task with so many to choose from. How can you choose with so many available ETF’s? Why ETF Labels are Confusing There are at least 44 different Financials ETFs and at least 188 ETFs across all sectors. Do you need that many choices? How different can the […]

A Tale Of Two Economies – It Was The Better Of Times, It Was The Worst Of Times

Nov 23, 2014

Jeremy Parkinson

Entertainment

Guest Post by Paul Kasriel, The Econtrarian As quantitative easing comes to an end (apparently) by the Fed and is taken up by the European Central Bank (ECB), let’s compare the behavior of nominal domestic demand in each central bank’s economy and venture a reason for any differences. Plotted in Chart 1 are index values […]

Lower Oil Prices And The U.S. Economy

Nov 23, 2014

Jeremy Parkinson

Entertainment

For the last 4 years, the national average retail price of gasoline in the United States stayed within a range of $3.25-$4.00 a gallon. But that all changed this fall, with U.S. consumers now paying an average price of $2.82. Source: New Jersey Historical Gas Price Charts Provided by GasBuddy.com This usually is the time of year when gasoline prices […]