Technical Market Report For September 2, 2017

Sep 02, 2017

Jeremy Parkinson

Finance

The good news is: The Nasdaq composite (OTC) closed at an all time high last Friday. The sellers left town early last week. Volume disappeared, new lows disappeared and the secondaries outperformed the blue chips. The Negatives The market is overbought. The first chart covers the past 6 months showing the OTC in blue and […]

E

NDX Just Made A New All-Time High But SPX And DJIA Did Not

Sep 02, 2017

Jeremy Parkinson

Finance

VIX retraced 86% of its rally, closing beneath its Intermediate-term support at 10.93. It is temporarily off its weekly buy signal. Confirmation comes above that level and the subsequent move may be very fast. Ending Diagonal patterns are known to completely retrace themselves, once broken. Could the initial foray have broken the trendline already? (Forbes) […]

Mexico’s Energy Reform: A New Horizon?

Sep 02, 2017

Jeremy Parkinson

Finance

Over the years, Mexico, one of the biggest producers of petroleum and other liquids globally, has transitioned from being a net energy exporter to a net importer of energy. What Led to the Change? The import dependence was a result of the steady decrease in oil production that started in 2005. To address the situation, in […]

US Dollar Resilience May Foreshadow Gains As Data Flow Slows

Sep 02, 2017

Jeremy Parkinson

Finance

Fundamental Forecast for the US Dollar: Neutral US Dollar impressively resilient after disappointing employment data Recent weeks hint USD more responsive to positive vs negative news Services ISM, Beige Book, Fed-speak may help greenback recovery The US Dollar continues to impress with its resilience last week. In the past three weeks, the greenback managed to navigate past political turmoil as well […]

Week In Review: This Week’s China Pharma Deals Top $1 Billion

Sep 02, 2017

Jeremy Parkinson

Finance

Deals and Financings Berry Genomics (SHZ: 000710), a Beijing diagnostics and sequencing company, completed its $648 million reverse merger that lists the company on the Shenzhen exchange (see story). Berry merged into a company formerly known as Chengdu Tianxing Instrument & Meter, but the company’s legacy business has been sold off and its name was changed to Berry Genomics earlier […]

A Return To Normalcy

Sep 02, 2017

Jeremy Parkinson

Finance

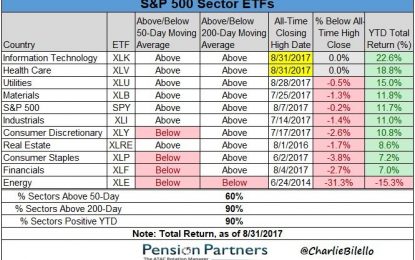

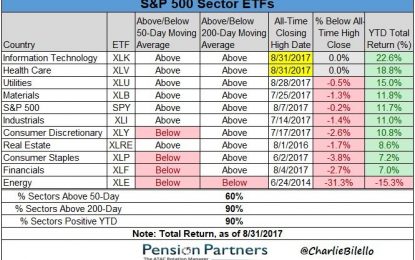

Review & Update The Rule of 20 The Risk To Passive Sector & Market Analysis 401k Plan Manager As I wrote this past Tuesday, we were lucky. Thousands who live along the Texas coastline were not. I am thankful. I am grateful. I am hopeful. The return to “normalcy,” for most of us, will take some time. It […]

Stocks Have A Great Week Despite Subpar Labor Report

Sep 02, 2017

Jeremy Parkinson

Finance

The main reason investors have been cautious heading into this week was because of the potential for a North Korean flare up. It turned out that the market decided to ignore the North Korean risk as the last week before Labor Day, when most people go on vacation, was fantastic. The Nasdaq was up 2.75% […]

Speculators Make Minor Position Adjustments, But Like That Aussie

Sep 02, 2017

Jeremy Parkinson

Finance

Speculators did not make any significant adjustment to gross positions, which we define as 10k or more contracts in the currency futures, during the CFTC reporting week ending August 29. However, the Australian dollar bulls came close by adding 9.4k contracts to the gross long position. It stood at 101k contracts, which is the highest since […]

A 5-Star Dividend Achiever ETF That’s Flying Under The Radar

Sep 02, 2017

Jeremy Parkinson

Finance

There are a lot of dividend ETFs out there to choose from, but this segment of the marketplace is fairly concentrated. Of the 170 ETFs categorized as dividend ETFs by ETFdb.com, just a dozen have more than $2 billion in assets. In other words, just a handful of dividend ETFs get most of the attention. […]

ECRI Weekly Leading Index: “Finding The Root Cause Of Recessions”

Sep 02, 2017

Jeremy Parkinson

Finance

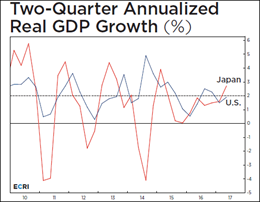

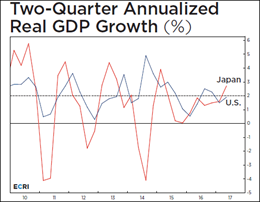

Friday’s release of the publicly available data from ECRI puts its Weekly Leading Index (WLI) at 143.9, down from the previous week. Year-over-year the four-week moving average of the indicator is now at 4.36%, down from 4.63% last week. The WLI Growth indicator is now at 1.9, also down from the previous week. “Finding the […]