EC

Four Central Banks Dominate The Week Ahead

Sep 03, 2017

Jeremy Parkinson

Finance

Four central banks from high income countries hold policy-making meetings in the first full week of September. They are the Reserve Bank of Australia, Sweden’s Riksbank, the Bank of Canada and the European Central Bank. Investors focus on the latter two. To be sure, no one expects the ECB to change rates or policy. At most, […]

Stocks Going Ex-Dividend The First Week Of September

Sep 03, 2017

Jeremy Parkinson

Finance

Here is our latest update on the stock trading technique called ‘Buying Dividends,’ also commonly referred to as ‘Dividend Capture.’ This is the process of buying stocks before the ex dividend date and selling the stock shortly after the ex date at about the same price, yet still being entitled to the dividend. This technique generally works only […]

E

New York Times Takes Aim At The Volatility Trade And Trading Crowd

Sep 03, 2017

Jeremy Parkinson

Finance

Through no fault of my own I’ve recently found myself at the heart of the mainstream, short- volatility (VOL), media headlines. Ok, maybe that’s a bit disingenuous and I should take a little bit more ownership of the role I’ve played over the last several years regarding the volatility/VIX trade. I have written several dozen […]

Uranium Miners Close To Very Bullish

Sep 03, 2017

Jeremy Parkinson

Finance

Uranium miners are close to become very bullish. In fact, so far, it seems that uranium miners have followed a textbook case of a mega breakout. If we look back, over the last 9 months, we see a secular breakout pattern. As annotated on the chart: “1” is the breakout point, where the long term […]

Focus On Gold, Silver And Precious Metals Mining

Sep 03, 2017

Jeremy Parkinson

Finance

This week I’ll focus on gold and silver. Here’s gold’s step sum chart going back to November 2010. For almost a year (November 2010 to August 2011) gold’s step sum saw an amazing ascent; rising from 220 to 275 (55 net advancing days) in a ten month period. That’s a lot, but then that’s what a […]

Markets Ignore Harvey As Hope For Tax Plan Lifts Stocks

Sep 03, 2017

Jeremy Parkinson

Finance

One of the tougher things around is learning the art of surfing. I can recall the phrase, “Getting Up,” as being the hardest part for surfers, that of pushing yourself to stand up on the board while the wave is forming in order to find “the tube.” I never was able to get up, but […]

Speculators Add To Expectations For Higher Gold And Silver

Sep 03, 2017

Jeremy Parkinson

Finance

The SPDR Gold Trust (GLD) accomplished a major milestone in the past week: it fully reversed its entire post-election loss in what looks like a major breakout. Yet one more “Trump effect” put to rest. Source: StockCharts.com Speculators have been rushing back to gold likely in anticipation of these much higher prices. Speculators have rushed to re-accumulate […]

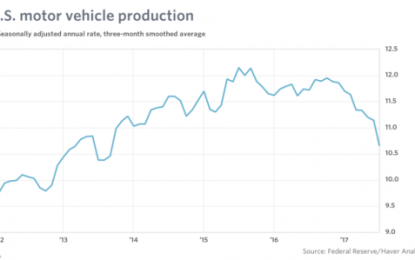

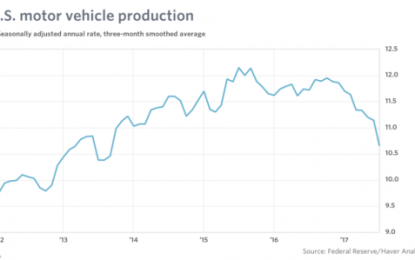

BLS Says Motor Vehicle Hiring Most Since February 2014: Anyone Believe This?

Sep 03, 2017

Jeremy Parkinson

Finance

Rex Nutting on MarketWatch offers this opinion: The jobs report shows a spike in auto jobs — and that doesn’t pass the smell test. Motor Vehicle Production Auto Hiring Manufacturing payrolls increased by 36,000 in August, three times as many as usual, and matching the highest monthly gain in four years. Better yet, the number of […]

The Winds Of Change

Sep 02, 2017

Jeremy Parkinson

Finance

By RCM Alternatives Eighty-nine percent of futures markets experienced a contraction of volatility in the first six months of 2017, which translates to a lack of trends for typical systematic Managed Futures managers for find Alpha from. Don’t look now – but there might be some needed movement taking shape in some markets. First up, […]

GBP: Outlook Improves Against Both USD And EUR

Sep 02, 2017

Jeremy Parkinson

Finance

Talking Points: The likelihood of tighter monetary policy in both the US and the Euro-Zone has lessened in recent days, potentially helping the British Pound against both. Meanwhile, the latest round of Brexit talks has now ended, removing a possible banana skin. As for economic data, a relatively quiet week lies ahead. Fundamental Forecast for GBP: Bullish The […]