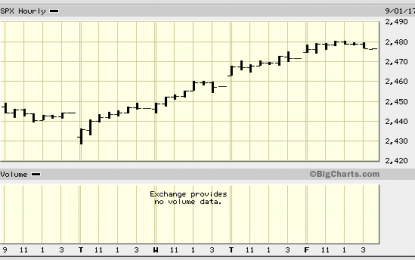

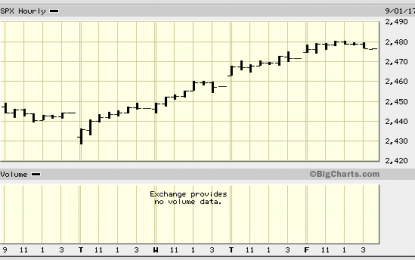

Weighing The Week Ahead: Time To Ask What Could Go Wrong?

Sep 03, 2017

Jeremy Parkinson

Finance

We have a very light data calendar. It is a short week with some post-vacation (ahem) attitude adjustment. There is little fresh news, but plenty of data from last week. FedSpeak is on high. It is a perfect setup for pundit pontification. Expect lots of navel gazing, with an emphasis on flaws. Many will be […]

Gold: Mega Breakout In Play

Sep 03, 2017

Jeremy Parkinson

Finance

Gold had a very strong week. Because of that it is now in the process of breaking out. If this rally continues it will mark the end of the 6-year bull market. The U.S. dollar falling to multi-year lows definitely helped gold’s strong bounce from $1200 to the current $1330 level. Although this feels like a huge […]

Hedge Fund CIO: “Want To Make A Grown Nerd Cry? Run A 500% Rate Increase Through His Risk Model”

Sep 03, 2017

Jeremy Parkinson

Finance

August is over, which means that Eric Peters, the CIO of One River Asset Management, is back to doing what he is so very good at: distilling the week’s events and latest financial and economic trends into pithy, one-paragraph aphorisms. Without further ado, here is an anecdotal excerpt from his latest weekend notes. Scary Movie […]

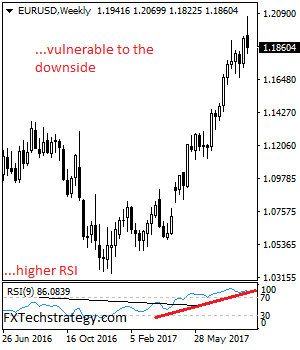

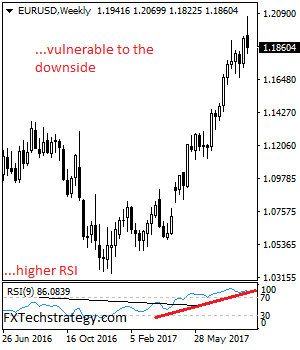

EURUSD Loses Upside Steam, Targets Further Weakness

Sep 03, 2017

Jeremy Parkinson

Finance

With the EURUSDpair rejecting higher to close lower the past week, more decline is envisaged. Resistance comes in at 1.1900 level with a cut through here opening the door for more upside towards the 1.1950 level. Further up, resistance lies at the 1.2000 level where a break will expose the 1.2050 level. Conversely, support lies […]

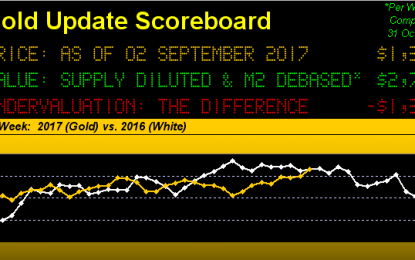

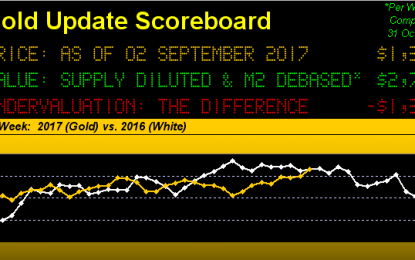

Gold Superb Through The Year’s Second Third

Sep 03, 2017

Jeremy Parkinson

Finance

For the fervent follower of Gold, to say it’s been “superb” year-to-date may seem at first blush an excessively exaggerated stretch, given the above panel’s showing us that price is but one point above where it was this time a year ago — and to just be in sync with currency debasement — ought […]

Weekly Economic & Political Timeline – Sept. 3

Sep 03, 2017

Jeremy Parkinson

Finance

This week will have a slightly heavier news agenda than last week, but there is little key U.S. data due so the overall effect may be the same. The agenda will be dominated by monthly policy commentaries and bid rates from the European Central Bank, the Bank of Canada and the Reserve Bank of Australia. […]

EC

Four Central Banks Dominate The Week Ahead

Sep 03, 2017

Jeremy Parkinson

Finance

Four central banks from high income countries hold policy-making meetings in the first full week of September. They are the Reserve Bank of Australia, Sweden’s Riksbank, the Bank of Canada and the European Central Bank. Investors focus on the latter two. To be sure, no one expects the ECB to change rates or policy. At most, […]

Stocks Going Ex-Dividend The First Week Of September

Sep 03, 2017

Jeremy Parkinson

Finance

Here is our latest update on the stock trading technique called ‘Buying Dividends,’ also commonly referred to as ‘Dividend Capture.’ This is the process of buying stocks before the ex dividend date and selling the stock shortly after the ex date at about the same price, yet still being entitled to the dividend. This technique generally works only […]

E

New York Times Takes Aim At The Volatility Trade And Trading Crowd

Sep 03, 2017

Jeremy Parkinson

Finance

Through no fault of my own I’ve recently found myself at the heart of the mainstream, short- volatility (VOL), media headlines. Ok, maybe that’s a bit disingenuous and I should take a little bit more ownership of the role I’ve played over the last several years regarding the volatility/VIX trade. I have written several dozen […]

Uranium Miners Close To Very Bullish

Sep 03, 2017

Jeremy Parkinson

Finance

Uranium miners are close to become very bullish. In fact, so far, it seems that uranium miners have followed a textbook case of a mega breakout. If we look back, over the last 9 months, we see a secular breakout pattern. As annotated on the chart: “1” is the breakout point, where the long term […]