Week In Review: This Week’s China Pharma Deals Top $1 Billion

Sep 02, 2017

Jeremy Parkinson

Finance

Deals and Financings Berry Genomics (SHZ: 000710), a Beijing diagnostics and sequencing company, completed its $648 million reverse merger that lists the company on the Shenzhen exchange (see story). Berry merged into a company formerly known as Chengdu Tianxing Instrument & Meter, but the company’s legacy business has been sold off and its name was changed to Berry Genomics earlier […]

A Return To Normalcy

Sep 02, 2017

Jeremy Parkinson

Finance

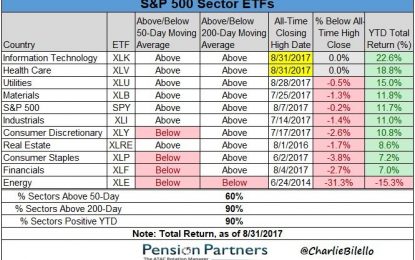

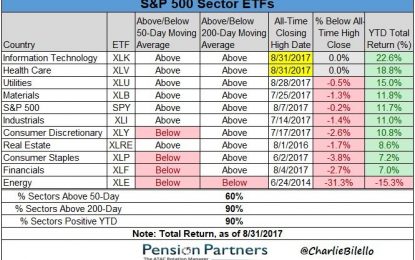

Review & Update The Rule of 20 The Risk To Passive Sector & Market Analysis 401k Plan Manager As I wrote this past Tuesday, we were lucky. Thousands who live along the Texas coastline were not. I am thankful. I am grateful. I am hopeful. The return to “normalcy,” for most of us, will take some time. It […]

Stocks Have A Great Week Despite Subpar Labor Report

Sep 02, 2017

Jeremy Parkinson

Finance

The main reason investors have been cautious heading into this week was because of the potential for a North Korean flare up. It turned out that the market decided to ignore the North Korean risk as the last week before Labor Day, when most people go on vacation, was fantastic. The Nasdaq was up 2.75% […]

Speculators Make Minor Position Adjustments, But Like That Aussie

Sep 02, 2017

Jeremy Parkinson

Finance

Speculators did not make any significant adjustment to gross positions, which we define as 10k or more contracts in the currency futures, during the CFTC reporting week ending August 29. However, the Australian dollar bulls came close by adding 9.4k contracts to the gross long position. It stood at 101k contracts, which is the highest since […]

A 5-Star Dividend Achiever ETF That’s Flying Under The Radar

Sep 02, 2017

Jeremy Parkinson

Finance

There are a lot of dividend ETFs out there to choose from, but this segment of the marketplace is fairly concentrated. Of the 170 ETFs categorized as dividend ETFs by ETFdb.com, just a dozen have more than $2 billion in assets. In other words, just a handful of dividend ETFs get most of the attention. […]

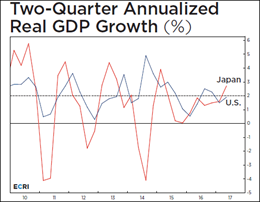

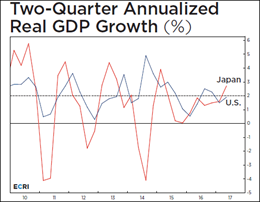

ECRI Weekly Leading Index: “Finding The Root Cause Of Recessions”

Sep 02, 2017

Jeremy Parkinson

Finance

Friday’s release of the publicly available data from ECRI puts its Weekly Leading Index (WLI) at 143.9, down from the previous week. Year-over-year the four-week moving average of the indicator is now at 4.36%, down from 4.63% last week. The WLI Growth indicator is now at 1.9, also down from the previous week. “Finding the […]

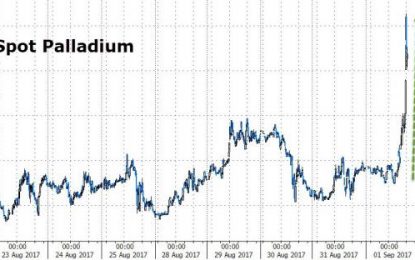

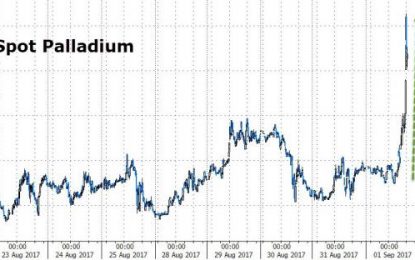

Palladium Suddenly Spikes To 16-Year Highs

Sep 02, 2017

Jeremy Parkinson

Finance

Amid hope for reinvigorated auto production (after Hurricane Harvey’s destruction) and Thursday’s escalation in US-Russia tensions (Russia being the world’s largest producer), spot Palladium was spiking on Friday, hitting its highest since record highs in January 2001. While the entire gamut of industrial and precious metals have been rising recently (the latter on the back of […]

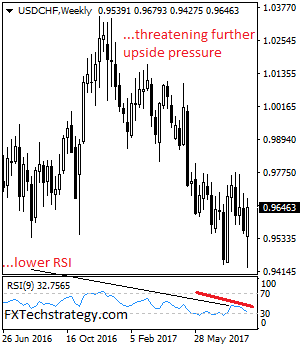

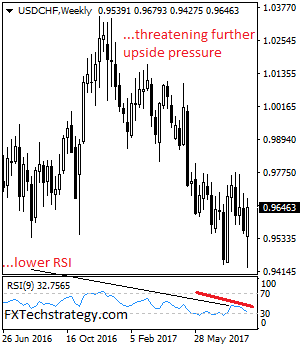

USDCHF Rejects Lower Prices, Eyes The 0.9772 Zone

Sep 02, 2017

Jeremy Parkinson

Finance

USDCHF: With the pair backing off lower prices to close higher the past week, more strength is envisaged in the days ahead. On the downside, support lies at the 0.9600 level. A turn below here will open the door for more weakness towards the 0.9550 level and then the 0.9500 level. On the upside, resistance […]

![Long Over The Long Weekend]()

Long Over The Long Weekend

Sep 02, 2017

Jeremy Parkinson

Finance

Seems traders took Friday off as we saw low volume and anemic action before start of the long weekend. The action remains looking very positive. Let’s enjoy the long weekend and see how trade resumes next week. SPY couldn’t get past the 248 resistance level but let’s see what comes next week. We should continue […]

EC

HH

The Ins And Outs Of Low Volatility ETFs

Sep 02, 2017

Jeremy Parkinson

Finance

If there’s one thing investors love, it’s consistency and reliability. Two attributes that deftly describe the trend of exchange-traded funds that track low volatility stocks. This unique category of the ETF universe has rapidly expanded in recent years through a combination of persistent fund flows and sector momentum. The factors that ultimately shape low volatility […]