Stage Analysis Gold And USD

Jul 11, 2017

Jeremy Parkinson

Finance

This post will use Weinsteins Stage Analysis to examine where we are in both Gold and the USD. For this analysis, I will use Weekly charts and highlight the Weekly 30ema as a guidepost for our analysis. First let’s start with a bit of History and go back to 1998 to 2002 to examine the […]

Gold Mildly Up On Short Covering

Jul 11, 2017

Jeremy Parkinson

Finance

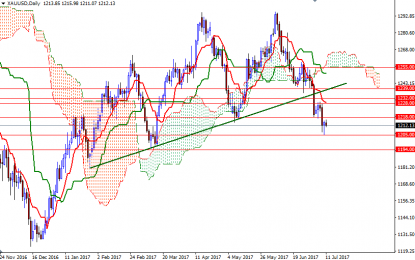

Gold started the week on the back foot, testing the $1208-$1205 area, but managed to recover its earlier losses and ended the day up $1.55 at $1214.09 an ounce. Gold has come under renewed pressure in recent days, as investors recalibrated their outlook on U.S. monetary policy in the light of recent economic data. The […]

EUR/USD, GBP/USD Approaching Confirmation Or Invalidation Zone Of Wave-4

Jul 11, 2017

Jeremy Parkinson

Finance

EUR/USD 4 hour The EUR/USD is moving sideways after failing to break above the previous top (red). A bullish breakout could however restart the uptrend towards the Fibonacci targets of wave 5 vs 1+3 and the round level of 1.15. 1 hour The EUR/USD expanded the wave 4 (orange) correction back to the 50% Fibonacci […]

EUR/USD: Trend Line Broken Through On The Hourly Timeframe

Jul 11, 2017

Jeremy Parkinson

Finance

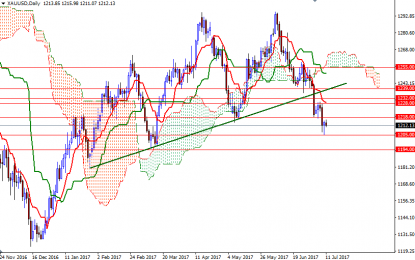

Previous: On Monday, trading on the euro closed slightly down and within Friday’s range (intraday bar). My expectations for Monday came off in full. In the first half of the day, the NFP report continued to provide support for the dollar. Given that the economic calendar was empty, euro bulls were easily able to induce […]

BoC: To Hike Or Not To Hike?

Jul 11, 2017

Jeremy Parkinson

Finance

On one hand, a rate hike in Canada is priced in. On the other hand, there is no 100% consensus among analysts that the BOC will indeed pull the trigger. Here are two opinions: Here is their view, courtesy of eFXnews: CAD: BoC Hike In The Price; Investors May Sell On Fact – Citi Citi […]

“… A Recession Has Always Followed”: Is This The Real Reason The Fed Is Suddenly Panicking?

Jul 11, 2017

Jeremy Parkinson

Finance

“Why is the Fed so desperate to raise rates and tighten financial conditions? Why has the Fed shifted from a dovish to a hawkish bias?” That is the question on every trader’s, analyst’s and economist’s mind in the past month. Is it because the Fed is suddenly worried it has inflated another massive equity bubble […]

E

USD/JPY Seeking More Strength

Jul 11, 2017

Jeremy Parkinson

Finance

USD/JPY is in a nice recovery since mid-June when the market turned up from 108.80 after a completion of a bigger three wave fall. That said as we can see bulls took charge and can now be unfolding a bigger impulsive structure. We see first waves one and two completed, which means recovery up from […]

WD-40 Company Q3 Sales & Earnings Results Reflect New Record Highs

Jul 11, 2017

Jeremy Parkinson

Finance

WD-40 Company (Nasdaq: WDFC), the San Diego, California based manufacturer and global marketing organization – in more than 176 countries and territories worldwide – of multi-purpose maintenance products manufacturer under the WD-40 and 3-in-One brands, today reported financial results for its third fiscal quarter (Q3) ended May 31, 2017 as follows: Total net sales: UP 2% […]

Will Top ETF Areas Of 1H Carry Momentum In 2H?

Jul 11, 2017

Jeremy Parkinson

Finance

It’s been over one week since we have entered the second half of 2017. Markets have so far been edgy in the latter half of the year with the S&P 500-based ETF (SPY – Free Report) adding about 0.2%, Dow Jones-based fund (DIA – Free Report) gaining about 0.4% and Nasdaq-based ETF (QQQ – Free Report) going down by about 0.2% […]

USD/JPY At The Highest In 4 Months – Riding Uptrend Support

Jul 11, 2017

Jeremy Parkinson

Finance

Dollar/yen finally breaks the cycle high of 114.37, trading at a new high of 114.46. Is this move for real? It is still awaiting confirmation. In any case, the pair extends its rise along the steep uptrend support line. The next high is 115.35, which was the high level in March. Beyond that point, 116 […]