Expecting 10% To 15% Correction In U.S. Equities

Apr 06, 2016Jeremy Parkinson0

I am of the opinion that the S&P 500 index is likely to decline by at least 10% to 15% in the coming months. In my view, this decline is likely to come sooner than later. I therefore advise caution and investors who are sitting on gains can consider some profit booking. In the recent […]

Today’s Trading Plan: Losing Momentum

Apr 06, 2016Jeremy Parkinson0

Technical Outlook: Biggest sell-off yesterday since March 8th, as price in one swoop dropped below the 5-day and 10-day moving averages. Two key price levels to watch today – 1) The Friday lows from last week. 2) The lows from March 24th. Particularly, if the latter should break, it would put in a lower-low into the […]

An Interview With Lee Ann Wolfin: Cresval Capital Corp.

Apr 06, 2016Jeremy Parkinson0

Interview with Lee Ann Wolfin, president of Cresval Capital Corp. (TSCV: CRV). Cresval Capital Corp. is exploring the 100%-owned MIKE Project (formerly the Bridge River/Copper claims), situated in the Lillooet Mining Division of southwestern British Columbia. This region is renowned for large-scale copper discoveries, exploration and mining. Video Length: 00:07:55

Are There Any Invesment Opportunities Left In 2016

Apr 06, 2016Jeremy Parkinson0

Does this sound familiar? You are tired because of the current market environment. Most of your holdings are in red, or neutral at best, since market volatility exploded last summer. You have tried investment services like paid e-newsletters from gurus worldwide, took consultations, read books … but your profitability has not improved, on the contrary. If this sounds […]

Why Are European Banks Performing Badly? The Santander Case

Apr 06, 2016Jeremy Parkinson0

European banks have under-performed both the S&P 500 and US banks by a wide margin. Santander has improved its bottom-line but its shares keep falling. The main difference between EU and US banks lies on non-performing loans. The unemployment rates in the US vs the EU help explain the under-performance. Photo Credit: Yukiko Matsuoka To say […]

E Halliburton – Maybe ValueAct Really Is “The Mullet”

Apr 06, 2016Jeremy Parkinson0

The proposed merger between Halliburton HAL and Baker Hughes BHI has received a lot of scrutiny over the past several months. Now the DOJ has added ValueAct Capital to the soap opera, suing the hedge fund for an antitrust violation: The lawsuit centers on a 40-year old U.S. law that exempts investors who buy up […]

Morning Call For April 6, 2016

Apr 06, 2016Jeremy Parkinson0

OVERNIGHT MARKETS AND NEWS Jun E-mini S&Ps (ESM16 +0.18%) are up +0.18% and European stocks are up +0.10% as energy producing stocks are higher with a +2.90% rally in crude oil. Crude oil shot higher late yesterday after the API reported that weekly U.S. crude supplies fell -4.3 million bbl. Also, a 2% gain in […]

T2108 Update – A Nervous Market Awaits More Fed Refreshments

Apr 06, 2016Jeremy Parkinson0

(T2108 measures the percentage of stocks trading above their respective 40-day moving averages [DMAs]. It helps to identify extremes in market sentiment that are likely to reverse. To learn more about it, see my T2108 Resource Page. You can follow real-time T2108 commentary on twitter using the #T2108 hashtag. T2108-related trades and other trades are occasionally posted on […]

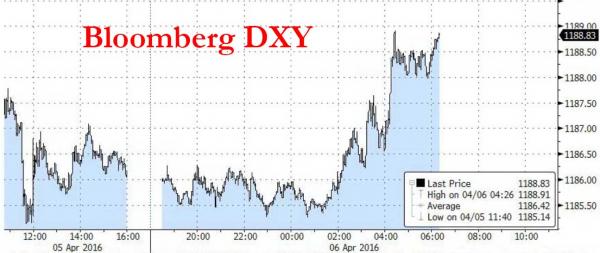

Stocks Rebound In Calm Trading On Back Of Stronger Crude, Dollar

Apr 06, 2016Jeremy Parkinson0

Unlike yesterday’s overnight session, which saw some substantial carry FX volatility and tumbling European yields in the aftermath of the TSY’s anti-inversion decree, leading to a return of fears that the next leg down in markets is upon us, the overnight session has been far calmer, assisted in no small part by the latest China […]

EUR/USD And GBP/USD Forecast – April 6, 2016

Apr 06, 2016Jeremy Parkinson0

EUR/USD The EUR/USD pair initially fell during the day on Tuesday, but turn right back around to form a bit of a hammer. The hammer of course is a bullish sign, and the fact that we formed this hammer at the very top of an uptrend tells me that the buying pressure is still very […]